Every bull run starts with a wave of capital inflows, something that excites those watching enough to cause FOMO. As a result of that FOMO, traders & paper holders get emotional about holding “this damn coin that just does nothing,”. All while watching others straight line up, then dump their positions at magically the wrong time.

It’s not about capturing the first wave of face melting profits. It’s about using that as an indicator to see how these things have actually worked out. There is one catch, however. You should only attempt this if you understand in order for this process to be successful, it must be observed and executed with little to no emotion. Also don’t listen to social media either or you will almost certainly fail.

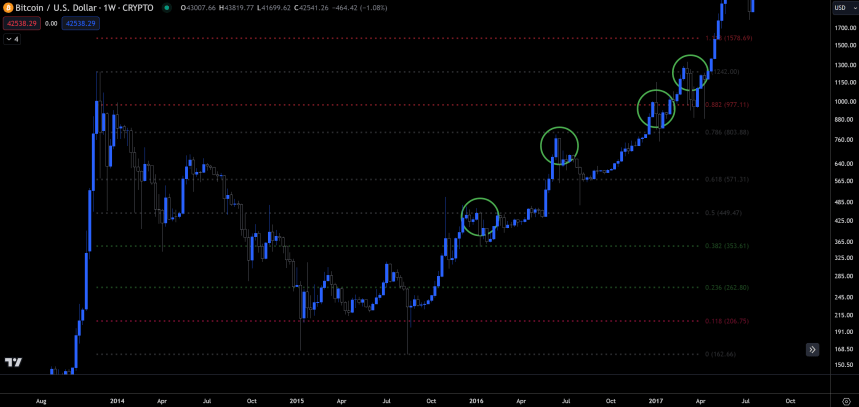

The wave of capital inflows run down, just like water. That being the case, let me tell you what we do know. Every bull run that preceded us began with Bitcoin grinding up to the Fibonacci 0.50 mark. It was only when BTC crossed that mark that things got exciting. The 15-17 bull run will be the main focus of this article, due to a word count cap.

Step One – Where Do I Start?

Since the bear market lows, Bitcoin has been the safest bet until the .50 fib. After that we have to monitor our radar for what has technically broken out across medium cap stocks that are doubling (+/-) BTC’s gains in the same time frame. Rotate your allocated trading amount into it without excuses, no “hodling” based on feelings, or “the team”, etc. This is not so much about that, as it is about the current eyes on them. Also just like Solana this cycle, and Ethereum during the 15-17 run, there should be plenty of time to scale out.

Step Two – Rotation Time

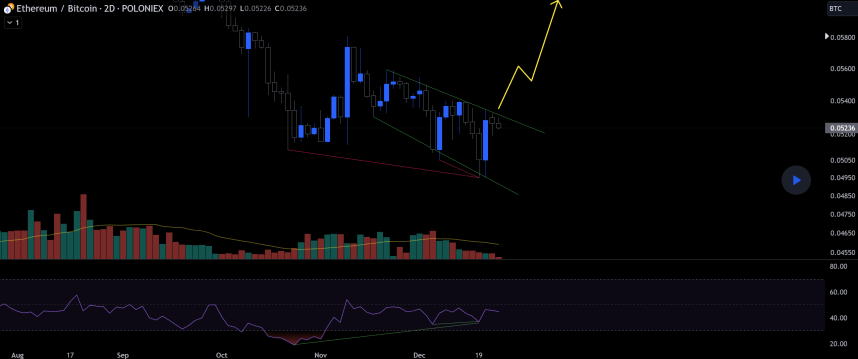

After that, I scale profits into the fundamentally strongest large and medium caps. Currently the ETH/BTC reversal (since writing price has broken out up) indicates that, and the strongest within its ERC-20 family (eg. LINK, MATIC, etc.) are the ones to watch at the moment IMO (as seen in the chart below).

Fortunately, with some trading education & experience, the timing of these things becomes much less of a guessing game. If you study Elliott’s Wave analysis, Wyckoff Schematics, chart patterns, volume, etc. When done correctly (as seen in the MATICUSD chart below) you can be on the bleeding edge of these runs. Which leads to a very happy Trading account.

Where I move weight to next has been at clear Fibonacci extensions of the runners, (which I’ve gauged from their prior movements). In this place I’ve seen it too many times to not understand and value that history may not repeat, but it often rhymes. You can most easily identify the next runners via their technical breakouts that took place as Bitcoin crept up the fib scale and corrected at the major POI’s (as seen on the chart below).

The mechanic of capital inflows, flow down the line, all the way through the small caps, micro caps & NFT’s, etc. The way to catch massive gains is relatively easy in a bull market if you’re in it from the beginning. The next trick is to keep profits.

Step Three – Securing Profits

To retain profits there are a number of ways to gauge targets as mentioned before with Fibonacci extensions, volume paired with weekly candles, sentiment, Fibs, Elliott’s Waves and Wyckoff’s Distribution Schematics are more than enough to come out of each run with suitcases of profit. So if that’s something that’s important to you, either take the time to put the work in to learn for yourself or always be at the whim of others’ advice.

If you’re interested in keeping up to date with the direction of capital inflows, what I’m doing and when, keep a lookout on NewsBTC or follow me on Twitter for breakout and other relevant charts when I release them, as the run continues, or DM me if you want to learn.

I’ll leave you with a few warnings that I’ve tried to share with my students and people close to me, which are spoken from experience and only stated in hopes that these words will protect anyone reading this from the same hard lessons I and everyone I know in this place have found out the hard way, at least once…

When you feel invincible, take profits. When your extended family or friends start asking for your advice on buying crypto, take profits, and inversely when they tell you to sell, don’t. Finally, one of the most useful pieces of advice I’ve learned is, only ever aim for the “meat of the move” not the exact top.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.newsbtc.com/crypto/crypto-capital-rotation-how-guide-riding-wave-inflows/