Billionaire investor Stanley Druckenmiller is uncertain about many things. We have not been in a situation, he says, where you have free money for 11 years, a very broad asset bubble, followed by jacking up rates 500 basis points in 12 months.

This is so complicated, he told the audience at the Norges Bank Investment Management conference last week.

But, he is fairly sure about one thing. “One area I feel reasonably comfortable in is, I’m shorting the United States dollar,” Druckenmiller said.

“Currency trends tend to run at least 2-3 years. We’ve had a long run here… something like $10 trillion, $13 trillion came into the US dollar during the previous decade.”

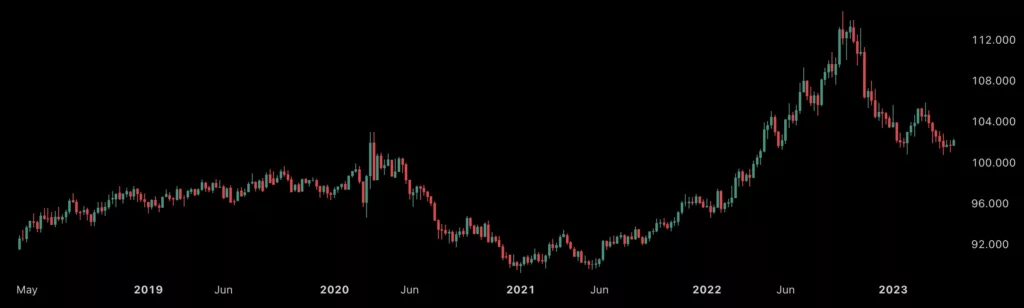

He missed the recent bull run however which saw the dollar strength index (DXY) rise from 89 in January 2021 to 114 in September 2022.

DXY has weakened since, finding some support at 101 with it to be seen whether it will hold or break down lower.

“The tightening in the US going forward will not be as much as the foreigners, we’ve weaponized the dollar and you got people like Lula running around asking why we need to be trading in US dollars.

So the only space I have risk on right now is the US dollar,” Druckenmiller says before adding “I’m also long on gold obviously for the same reasons.”

He has bitcoin too, though he did not mention them at the conference, but back in 2020 said: “if the gold bet works, the bitcoin bet will probably work better because it’s thinner, more illiquid and has a lot more beta to it.”

So he is basically saying short the dollar and buy bitcoin, though naturally he pointed out that he could change his mind next week so he is just expressing a view, not telling people to do it.

Pressure on USD

The dollar is at an historically high value currently, though it has fallen from its recent peak last autumn.

As has gas and oil. Brent crude fell below $80, while gas is down to $2.2 from $10 in August. They both tend to be priced in USD, so their spike last year contributed to the dollar strength.

Oil may have more down to go. It was around $50s pre 2020, and since then there has been a great rollout of renewables in Europe and US, structurally adding pressure to the price.

Both the British and the European Central Bank have now largely caught up with the front-running Federal Reserve Banks, so that edge in the dollar strength has gone.

And there continues to be much talk regarding de-dollarization with the newly elected Brazilian president Lula da Silva talking about creating a regional currency, like the Europeans he was quoted as saying.

He had that idea when he was previously president as well back in the tens, and that didn’t go anywhere in part because Brazil’s neighborhood is quite a big fiat mess with Venezuela still hyperinflating some ten years on while galloping inflation rages in Argentina.

He could potentially instead go with a BRIC currency, but that would just be exchanging the dollar for the yuan with Brazil still having no say over either.

In our view therefore the de-dollarization talk is a bit hyped because Russia has an interest in hyping it as they’re outside the global financial system right now and are trying to find ways in, including by potentially using crypto “especially for foreign trade,” their deputy Foreign Minister reportedly said.

But there are concrete factors putting downwards pressure on DXY and DXY tends to inversely correlate with bitcoin, though it is a weak correlation.

Hard Landing?

Druckenmiller also said that he is in the hard landing camp. He said there might be such hard landing in autumn, but the recent US GDP data showed a pickup year on year for Q1 2023 to 1.6% from 0.9%.

Most expected Q1 to show growth however, with the big question being what Q2 will show and then Q3 in September.

It is possible the US economy will show resilience despite straight maths in light of $1 trillion taken out of circulation, but Druckenmiller uses the events of March to try and predict what will happen if there is a hard landing.

Following the failure of the Silicon Valley Bank, the Federal Reserve printed some $300 billion, reversing much of a year long tightening.

Druckenmiller has no confidence that Fed’s chair Jerome Powell will hold firm if there is a hard landing, and therefore his bet is the dollar will weaken quite a bit more. If it does, then bitcoin should strengthen considerably.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://www.trustnodes.com/2023/05/02/short-the-dollar-says-stanley-druckenmiller