Over the past decade, the fintech industry has experienced a significant surge, primarily driven by the absence of dependable customer service, outdated interfaces, and limited innovative tools and features.

The Driving Force Behind Banking Development

Banking as a Service (BaaS) has the potential to facilitate rapid and effortless expansion of services for fintech companies. Moreover, it offers banks an opportunity to generate additional revenue streams and tap into untapped customer segments. The growing demand for a broader array of financial services among fintech companies is expected to drive the increasing popularity of BaaS.

Necessity Will Drive Banking Innovation in 2023

With the increasing popularity of fintech companies, customer expectations for cutting-edge banking applications have also risen.

Mobile banking has become a prevalent choice, with more than three-fourths of the U.S. population utilizing it, and the global number of digital banking users projected to reach

3.6 billion by 2024. In order to remain competitive, it is crucial for banks to integrate mobile services.

However, many banks and financial institutions lack the necessary resources to implement new technologies that can compete with the highly innovative fintech companies. Additionally, fintech companies are not necessarily interested in taking on the full responsibilities of being a bank, including adhering to strict compliance regulations.

The key insight is that these fintech companies do not aim to become banks, nor do most banks have extensive plans to digitize to the level of leading fintech applications.

Instead, fintech companies are leveraging banks, which provide the regulatory sponsorship and banking technologies behind the scenes, enabling the provision of these products.This collaborative offering is commonly referred to as Banking as a Service (BaaS).

The Growth and Significance of Banking as a Service

The rise of user-friendly and flexible services provided by digital neobanks and fintechs has disrupted the financial services industry. However, certain capabilities within the industry, such as issuing payment cards and holding deposits, necessitate the involvement of licensed banks.

Consequently, banks have embraced Banking as a Service (BaaS) as a means to collaborate with new players and embrace the digital banking revolution.

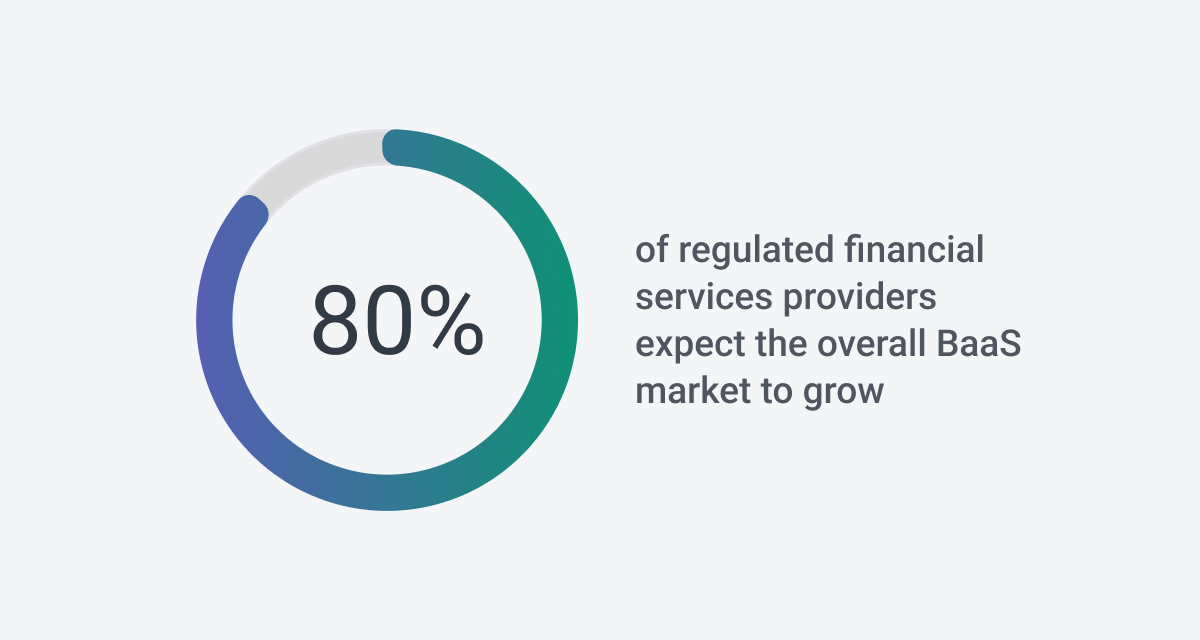

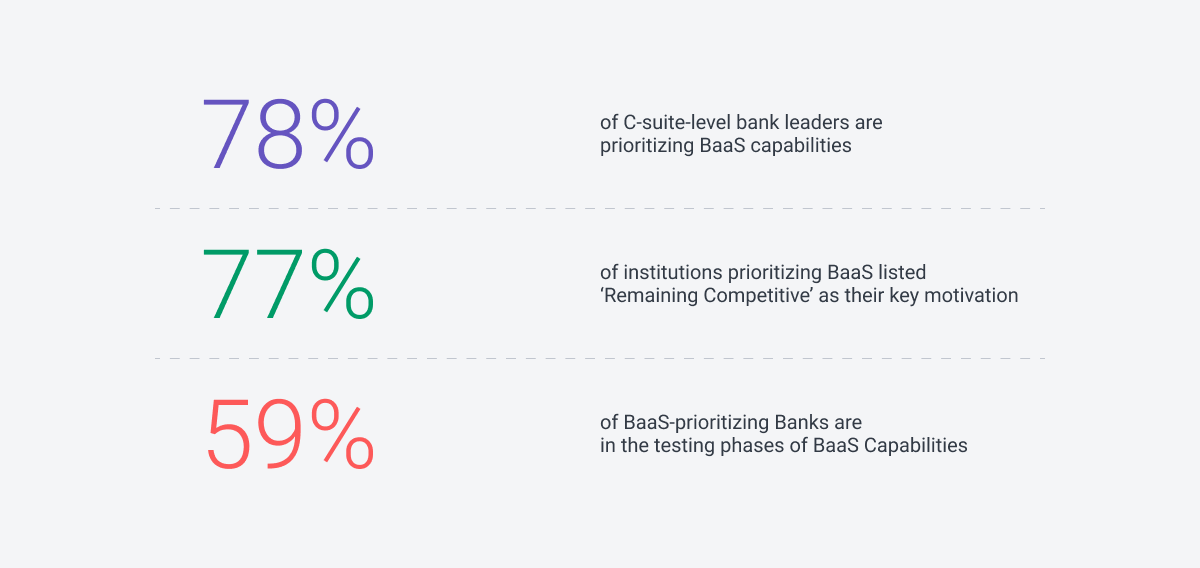

The surge in consumer demand for digital financial services has sparked a BaaS phenomenon, with

78% of bank leaders at the C-suite level prioritizing the integration of BaaS capabilities.

According to a recent survey conducted by

Finastra among senior executives in the financial services sector, 85% of respondents have already implemented or plan to implement BaaS within the next 12-18 months. The projected market opportunity for BaaS stands at an impressive $7 trillion.

By leveraging BaaS, banks can maintain their competitiveness, meet customer expectations for convenience and speed, and adapt to the ever-evolving landscape of the financial services industry.

BaaS Benefits for Fintechs

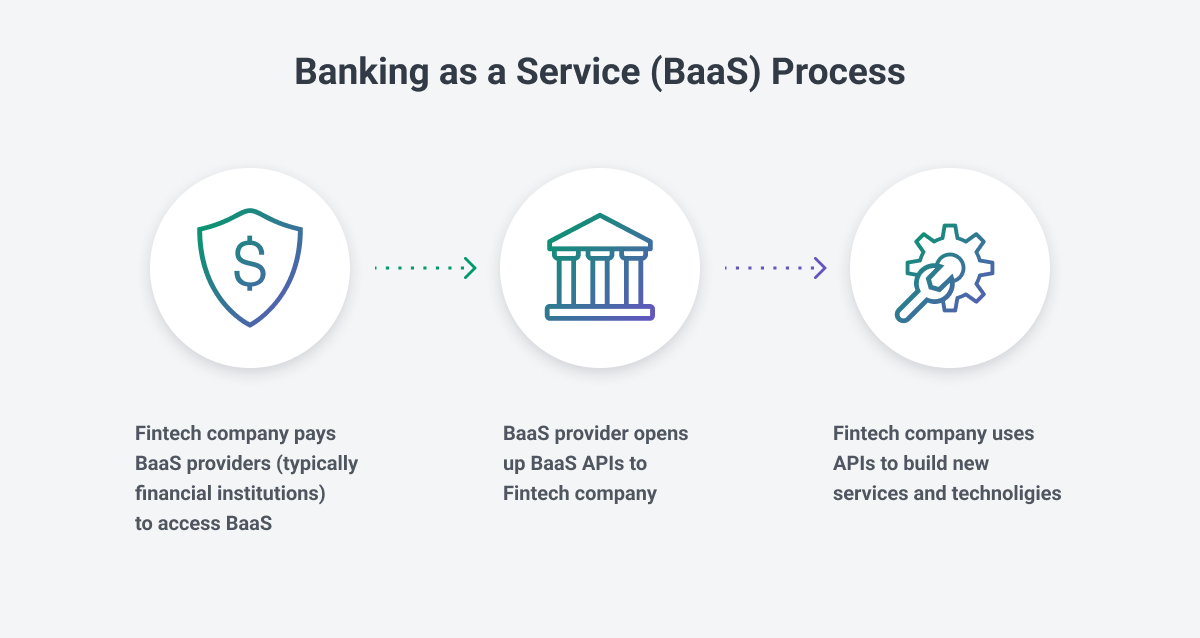

In simple terms, Banking as a Service (BaaS) is a partnership arrangement between a licensed bank and a non-bank or fintech company. Through this collaboration, the licensed bank grants the non-bank access to its regulated infrastructure and core systems using APIs (application programming interfaces) in exchange for a fee.

With this access, the non-bank or fintech company can provide banking services to its customers using its own user interface and platform.This process is often referred to as “white-label banking.” It allows non-banks to expand their range of financial services, such as holding deposits or issuing payment cards, by leveraging the resources and regulatory framework of the licensed bank.

By partnering with a licensed bank through BaaS, non-banks can offer enhanced customer experiences more efficiently and rapidly, without the need to obtain their own banking license or develop core banking systems from scratch.

This enables non-banks to concentrate on integrating banking functionalities into their existing platforms, creating a more comprehensive and seamless offering for their users.

BaaS Benefits for Banks

Banking as a Service (BaaS) brings forth numerous benefits for fully licensed financial institutions, ensuring their relevance in an ever-changing financial landscape both in the short and long term.

-

New Revenue Streams: BaaS opens up avenues for creating fresh revenue streams by granting API-based access to core banking products and services. These can be offered to other businesses and non-bank partners on a recurring or per-service basis. Additionally, revenue can be generated through set-up charges or revenue-sharing agreements.

-

Customer Acquisition and Retention: BaaS allows financial institutions to efficiently acquire and retain customers. By partnering with non-bank brands that possess large and dedicated customer bases, banks can reach new potential customers at a lower cost compared to direct acquisition. Customized, easily accessible services provided through BaaS meet the expectations of modern customers, leading to increased satisfaction, loyalty, and better retention rates

-

-

Access to Modern Technology: BaaS facilitates the modernization of technological capabilities for banks. By utilizing leaner, more flexible, and powerful API-based tech systems, banks can streamline development processes, reduce infrastructure costs, and enhance data security. Breaking down internal product silos, improving interoperability, and gaining a holistic view of their customers’ financial lives become achievable through BaaS.

-

Relevance in the Market: Embracing BaaS allows banks to redefine their value proposition and position in the financial services ecosystem. This enables them to stay competitive and relevant as the industry undergoes transformation. Banks that hesitate to adopt BaaS risk losing market share, new customers, and potentially becoming obsolete.

The Relationship Between APIs, Open Banking, and BaaS

In BaaS, financial organization integrate entire services into their apps to have access to all allowed bank services, such as mobile bank accounts, debit cards, loans, and payments.

Open banking is a more general concept that involves different banks and allows opening their data and services to third-party developers through APIs. In open banking, financial institutions can access customers data and their accounts, and trigger allowed payments via API. But they do not integrate the entire banking service into their app.

Open banking enables consumers to develop and maintain a large network of financial relationships, creating pushback for banks to change their business models.

The technology behind open banking utilizes APIs, and through open banking, APIs have been used to connect banks with third-party providers, allowing the creation of Banking-as-a-Service functionality. BaaS connects fintech companies to banking systems through APIs, helping them create better financial products.

Open banking offers financial institutions a chance to increase revenue streams by expanding their customer base. According to research from

Polaris, the global open banking market size was valued at $16.1 billion in 2021 and is expected to grow and reach $128 billion by 2030.

Cybersecurity Threats for Banking as a Service in 2023

While BaaS is promising for fintech companies and banks, it does bring concerns about potential security threats. Some of the most notable examples of security threats and issues when using BaaS:

- Data breaches – BaaS platforms can be a target for hackers who want to steal sensitive data.

- SSL-based attacks – SSL protocol and implementation flaws are also a significant threat to BaaS users.”

- Misconfigurations – As BaaS environments operate in the public cloud, organizations must consider cloud applications’ unique cyber threats.

Cloud misconfigurations can be one such threat as they may leave sensitive data exposed to unauthorized access. Not to mention the human factor that can cause misconfigurations.”

Social engineering and vulnerability attacks are also becoming increasingly frequent, with threat actors exploiting gaps in software or hardware that have not been updated with the latest patches.

Additionally, recent evidence shows that smaller community banks are equally susceptible to cyberattacks as larger ones. Therefore, the demand for improved cybersecurity will continue to rise significantly.

All of these factors prove that it’s more important than ever for banks to maintain strong security measures and invest in fraud prevention and detection tools to respond quickly to security breaches. Otherwise, they may put themselves at risk of a data breach, which — according to the

2022 IBM Cost of a Data Breach Report — can exceed $5 million on average in the financial services industry.

Banks Can Leverage Fintech Security Measures to Fight Fraud

While banks may face increasingly high amounts of security threats, by partnering with fintech companies, they may have access to the latest security measures for safeguarding digital wallets, exchanges, and other online accounts.

By collaborating with fintech companies, banks can leverage technologies such as two-factor authentication (2FA), 3D Secure, tokenization, artificial intelligence (AI), and machine learning (ML) to enhance app security, automate fraud detection, and ensure identity protection.

The Rise of BaaS for Credit and Debit Card Services

In the fintech industry, an interesting phenomenon has emerged where neobanks and non-financial companies are providing credit card services.

Previously, cards were only issued by banks, such as national brands like Amex, Bank of America, or Chase, or smaller regional banks and credit unions. Today, neobanks like Cash App, Chime, or Varo are issuing cards. In reality, the cards themselves are actually provided by small regional banks, not the neobank or Fintech company whose name is on the card.

Other non-bank startups are also providing branded cards, a good example being Brex and Ramp, which provide corporate cards, and DoorDash and Instacart, which offer tech-enabled prepaid cards to their drivers.

These companies use the Banking as a Service (BaaS) model, partnering with a financial institution and an issuer processor, who provide the regulatory and technical infrastructure as a service, allowing any company to issue debit or credit cards.

Get Ahead of the BaaS Curve

As the banking industry continues to experience growth and more insights into the needs of end-users, it has become increasingly clear that BaaS solutions are the way of the near future.

With many banks looking to develop partnerships and offerings in the fintech space, it is important for businesses to work with

experienced providers who understand the unique challenges and opportunities of the industry.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://www.finextra.com/blogposting/24260/transforming-banking-exploring-the-landscape-of-banking-as-a-service-in-2023?utm_medium=rssfinextra&utm_source=finextrablogs