We are on the threshold of massive financial changes, and I’m not talking about the distant future but about something happening now. In 2023, real world asset tokenization again emerged on the radars of financial institutions and investors, resulting in

a new round of popularity and adoption.

Why is the surge of interest actually happening? Businesses are tired of lengthy and complicated procedures offered by traditional institutions. They are seeking ways to accelerate operations, optimize costs, and improve the efficiency of resources. So,

it has always been a matter of time. Finally, regulators and governments globally have agreed on necessary regulatory changes to empower the launch of their own RWAs and start benefiting from them.

Now, companies and teams that have been growing and maturing their digital asset capabilities and expertise are having their moment of glory. Innovative solutions, like DCM’s platform that gives funds, banks, and financial institutions the ability to tokenize

their real-world assets and payments, are starting to drive secure and interoperable digital asset transactions. Meanwhile, initiatives from major financial institutions like BlackRock signaling a significant shift toward blockchain-based fund management,

underscoring the evolution from niche to mainstream acceptance of asset tokenization. The

$245M gainings of BlackRock’s BUIDL in its first week once again prove the relevance of the innovation and the readiness of the market.

Tokenization is a digital present for finance

Asset tokenization on blockchain offers a novel solution to traditional illiquidity barriers, redefining asset fractionalization and enhancing market accessibility. Assets ripe for tokenization span across public markets (equity, fixed income, commodities),

pre-IPO stocks, wholesale bonds, physical art, and private funds and debt, indicating a diverse and expansive future market. Consequently, what used to be accessible to only a limited group of investors could now be traded on digital platforms with more flexible

investment options. The transition from traditional to on-chain tokenization will broaden the array of asset classes, include more stakeholder groups, and extend regulatory frameworks.

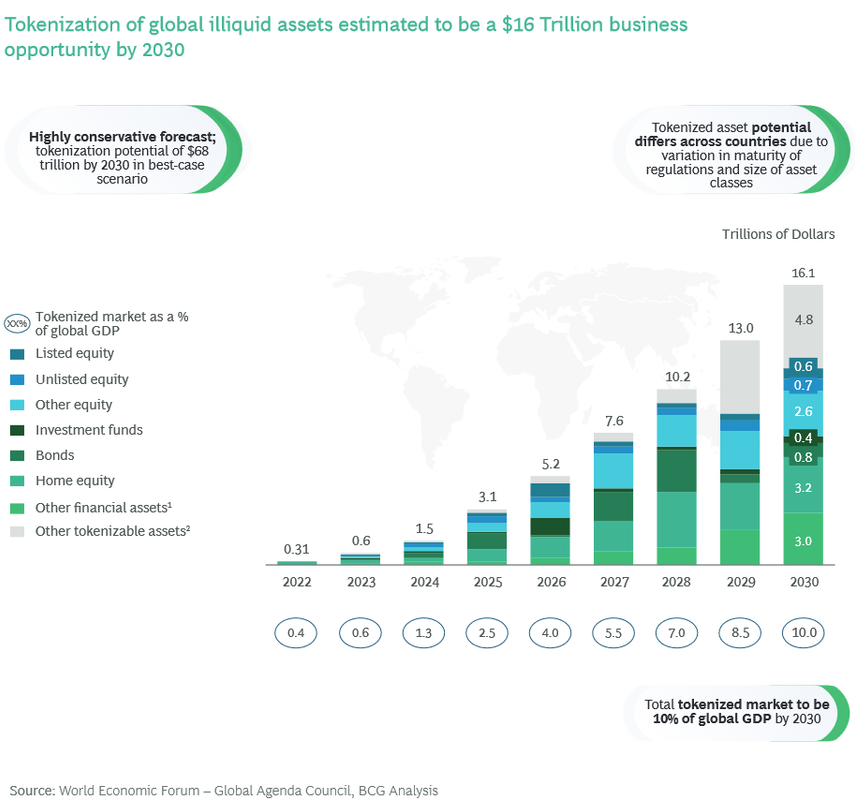

With that said, it is hardly surprising that the tokenization of global illiquid assets is projected to unlock a

$16 trillion business opportunity by 2030. Or even $68tn in the best-case scenario.

You may wonder if there are any conditions for this to happen. Admittedly, key phases in asset tokenization include establishing cross-platform interoperability, token and rule configuration, distribution, and executing corporate actions, forming a comprehensive

roadmap for digital asset management. All that will require close collaboration between regulators, tech providers, and traditional institutions to create a universal regulatory regime, fostering innovation, interoperability, and inclusion. However, it has

already begun, and businesses shouldn’t be merely sitting out.

RWA tokenization is not a passing trend but a transformative force that will shape the future. The widespread adoption of tokenization is poised to revolutionize investment strategies, democratize access to previously exclusive asset classes, improve the

stability of financial markets, and introduce a new era of financial inclusivity and innovation. So, don’t miss the opportunity.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.finextra.com/blogposting/25976/the-next-16tn-opportunity-in-crypto-you-are-missing?utm_medium=rssfinextra&utm_source=finextrablogs