In the ever-evolving landscape of real time trading, the integration of artificial intelligence (AI) with classical technical analysis represents a significant leap forward. At the forefront of this revolution are trading robots, equipped with sophisticated

pattern recognition algorithms that have the ability to sift through vast amounts of market data in real time. These algorithms leverage machine learning techniques to detect notable chart patterns such as the Cup and Handle, Flag, and Head and Shoulders,

each with unique characteristics that signal potential future price movements. This article delves deeper into the intricacies of real time patterns, their historical significance, and the pivotal role they play in modern trading strategies empowered by AI.

The Cup and Handle Pattern

Historical Context and Characteristics: The Cup and Handle pattern, first brought into prominence by William J. O’Neil in 1988 through his seminal work, is characterized by its resemblance to a teacup. This pattern is formed by a price consolidation that

leads to a “cup” formation, followed by a smaller pullback that forms the “handle”. The completion of this pattern, with a breakout above the handle, is seen as a bullish signal indicating a potential upward price movement.

Key Points for Traders:

-

Formation Duration: The pattern can take anywhere from several weeks to a year to form, making it applicable across a range of time frames.

-

Volume Analysis: A key to its confirmation is a noticeable decrease in volume during the handle’s formation, followed by a significant increase upon the breakout.

-

Depth and Shape: The depth of the cup and the roundness of its bottom are critical. A shallower cup suggests less volatility and a stronger signal, while a more rounded bottom indicates a solid consolidation period.

The Flag Pattern

Dynamics and Interpretation: Emerging during a strong, directional price movement, the Flag pattern resembles its namesake, consisting of a swift and steep price move forming the “flagpole,” followed by a short consolidation phase that creates the “flag.”

This pattern is a continuation signal, suggesting that the prior trend is likely to resume after the breakout from the consolidation.

Key Points for Traders:

-

Pattern Validity: For a Flag pattern to be considered valid, the consolidation should not retrace more than 50% of the flagpole.

-

Time Frame: This pattern generally forms over a short period, from a few days to a few weeks, making it ideal for short-term trading strategies.

-

Volume Consideration: Volume should diminish during the flag’s formation and increase significantly upon the breakout, confirming the continuation of the trend.

The Head and Shoulders Pattern

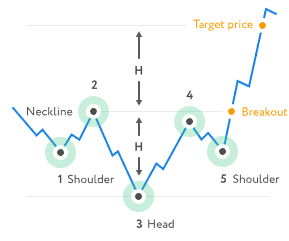

Description and Trading Implications: The Head and Shoulders pattern is a reversal indicator, recognized by its three peak formations – a higher peak (head) flanked by two lower ones (shoulders). This pattern signals the end of an uptrend and the beginning

of a downtrend, providing a strategic entry point for traders looking to capitalize on this shift.

Key Points for Traders:

-

Pattern Duration: A longer formation period increases the reliability of the pattern.

-

Volume Trends: Ideally, volume decreases during the formation of the right shoulder and increases as the price breaks below the neckline, reinforcing the reversal signal.

-

Target Projection: The distance from the head to the neckline can be projected downward from the breakout point to estimate the potential decline in price.

AI in Real Time Pattern Recognition

The advent of real-time pattern recognition in stock trading has marked a pivotal shift in how market participants approach decision-making and strategy formulation. Traditional patterns like the “Head and Shoulders,” “Cup and Handle,” and the “Flag” are

now being identified in the moment, offering traders a significant edge. This immediate recognition facilitates timely decisions, enabling traders to seize transient market opportunities that would otherwise slip by unnoticed. Beyond the obvious advantages

of speed, this technology plays a crucial role in risk management by providing real-time alerts on emerging patterns, thereby allowing traders to implement proactive strategies to mitigate potential losses.

The integration of AI-driven pattern recognition systems has revolutionized the trading landscape, freeing traders from the time-consuming task of manual analysis. This automation not only enhances efficiency but also allows traders to dedicate more time

to the development of sophisticated strategies. Furthermore, the ability to align these real-time patterns with other market indicators significantly reinforces the confidence in decision-making processes, ensuring that strategies are not just reactive but

are backed by a comprehensive analysis.

Precision in identifying the exact moments for trade entry and exit is another standout benefit, leading to improved outcomes in trades. Additionally, adaptability to the ever-changing market conditions is enhanced, ensuring that the trading strategies remain

relevant and effective. In essence, real-time pattern recognition is not just a tool for enhancing individual trades; it represents a transformative approach to trading, where efficiency, risk management, and strategic adaptability converge to create a more

dynamic and responsive trading environment.

Sergey Savastiouk, with a Ph.D. and serving as the CEO and Founder of Tickeron, highlighted the difficulty of crafting effective trading strategies for beginner traders. He noted that this involves more than just creating a proficient trading algorithm; it

also necessitates making it extremely accessible to users. Leveraging their significant expertise in creating trading robots, they have risen to this challenge by offering beginner traders a diverse selection of robots tailored to their needs.

Conclusion

The Cup and Handle, Flag, and Head and Shoulders patterns have stood the test of time as powerful tools for traders, offering insights into potential market movements. With the integration of AI and machine learning, the process of identifying these patterns

has been revolutionized, allowing traders to act on reliable signals with greater speed and precision. However, it’s crucial for traders to remember that no pattern or system can guarantee success on its own. Combining these patterns with other forms of analysis

and maintaining a disciplined trading strategy are essential steps toward achieving long-term success in the financial markets.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.finextra.com/blogposting/25981/revolutionizing-intraday-trading-with-ai-powered-search-of-popular-patterns?utm_medium=rssfinextra&utm_source=finextrablogs