HodlX Guest Post Submit Your Post

Despite heightened volatility in the crypto market, the first quarter of 2023 has ended on a good note. In this article, we’ll review developments in the crypto market and macro environment and provide predictions for the next quarter.

Bitcoin ntering consolidation after a strong rebound

The crypto market performed strongly in Q1 2023, with the total market cap growing by 49% to $1.19 trillion. Bitcoin (BTC) rose 72% and closed at $28,440, while Ethereum (ETH) rose 53% and closed at $1,827.

This upward trend was driven by multiple factors, including tightened monetary policies and the bank crisis. However, indicators such as increased outflows from stablecoins and capital outflows from exchanges show that this trend may not be sustainable.

BTC rebounded after testing the support at $15,000 in Q1. Into a new quarter, BTC is also entering a new journey in terms of weekly and monthly lines.

We applied the DC (Donchian channel) indicator to assess the volatility of the market. The indicator consists of an upper band, a lower band and a middle band which usually represents the 20-day high, 20-day low and the average, respectively.

When the prices are stable, the DCs will be relatively narrow, and when there is heavy price fluctuation, the indicator channels will be wider. The indicator is helpful for determining buy and sell signals.

When prices break above the upper band, traders might interpret it as a buy trade. When prices break below the lower band, traders might interpret it as a sell trade.

Weekly chart

Judging from the DC indicator, the weekly line of BTC still goes below the middle band of $320,000 and it has been slightly fluctuating for over two weeks after the strong rebound. It seems that BTC is still in a post-rebound consolidation phase at the weekly level.

Meanwhile, the ATR (average true range) indicator has emerged from a long-term downtrend but is still at a low point in the cycle, indicating that the market is still in consolidation.

Therefore, by combining the two indicators, we believe if the weekly line breaks meaningfully above the middle band while the ATR indicator also reverses and breaks through then it means that BTC will enter a strong upward phase, and it is advisable to enter the market at an appropriate time.

Monthly chart

The monthly line of BTC has just experienced three consecutive bullish candles, but it has yet to reclaim the loss from last June when BTC started at $35,000.

Combined with the centerline of the DC indicator in the weekly chart, we believe $32,000 might be the next major resistance level.

Applying the DC indicator, we can see the monthly line of BTC is still under the middle band but is high above the lower band.

Meanwhile, the ATR indicator continues to be in a long-term downtrend. This means an immediate reverse might not be in sight.

For the quarter, BTC achieved a strong rebound with a nearly 80% increase. This is a good signal for long-term investors, indicating that the quarterly trend has reversed and will enter a new phase of sideway consolidation.

US stocks npredictable due to macro uncertainties

US stocks’ performance in the first quarter was in line with expectations with fundamentals and technical indicators both in bullish mode.

Firstly, the PCE’s (personal consumption expenditures) below expectation year-on-year increase of five percent indicated mitigated inflationary pressure, which boded well for the stock market.

Secondly, the US economy remained strong, and corporate profits continued to grow, providing support for the rebound of US stocks.

Thirdly, the employment rate looked good, which gave American companies more opportunities. And in the policy front, the Federal Reserve’s change of attitude also contributed to reducing downward pressures on the market.

In Q1, the S&P 500, Dow Jones and Nasdaq all performed strongly, with the Nasdaq leading the increase due to the outperformance of tech stocks. Meta and Tesla shares both increased by over 60%.

On the contrary, bank shares underperformed badly. Both the KBW Nasdaq Bank Index and the KBW Nasdaq Regional Banking Index suffered declines.

We believe the US economy is at a crossroads in choosing between continued growth in the stock market and an economic recession, and one of the largest risks the market will face in the upcoming months will be the US economy falling into stagnation.

The upcoming Q1 earnings season and key economic data releases should have a great influence on the performance of the market especially the data on corporate profits and economic growth.

The Fed turning more dovish under this backdrop will be conducive to a recovery of the market. It should be acknowledged that the overall rise of the S&P 500 has covered the sluggishness of the whole market, and big tech stocks have become safe harbors for investors.

Performance of the US stocks in Q2 is unpredictable due to the continued existence of some uncertainties from last year especially the impact of rate hikes on the US economy.

Although S&P 500 has been in sideway movements lately, daily volatility is increasing, making it difficult to assess the true healthiness of the market.

As S&P 500 companies successively release their Q1 earnings, we believe the EPS predictions will be reduced. Also, we think the trend of narrowing profit margins might continue until the end of the year before restoring growth.

US bonds o suffer from accelerated de-dollarization

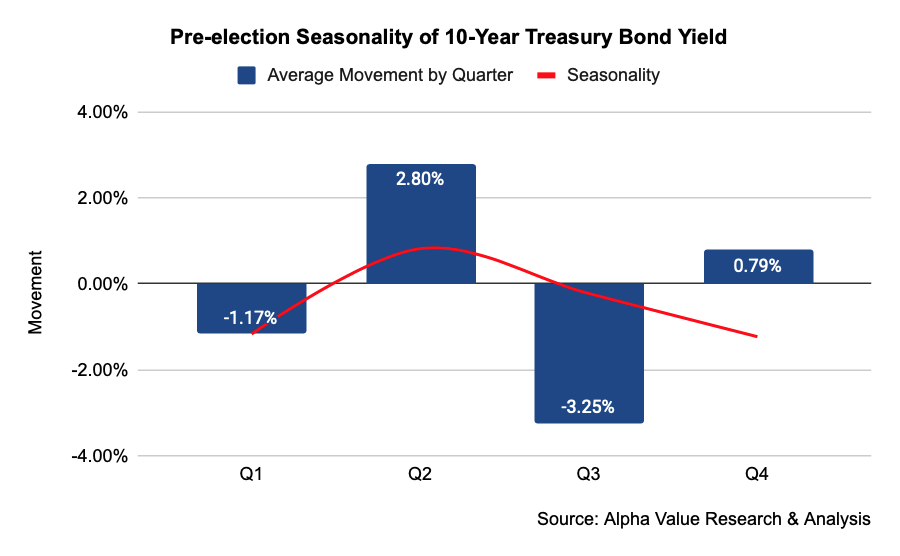

The US 10-year Treasury yield often stays in long-term downtrends, but every time it rises to the upper edge of a downtrend channel, a global financial crisis occurs.

This time, the speed and degree of its upward breakthrough were unprecedented in 40 years.

At present, the yield curve of US Treasuries is rapidly turning positive, which could be a harbinger of a US economic recession.

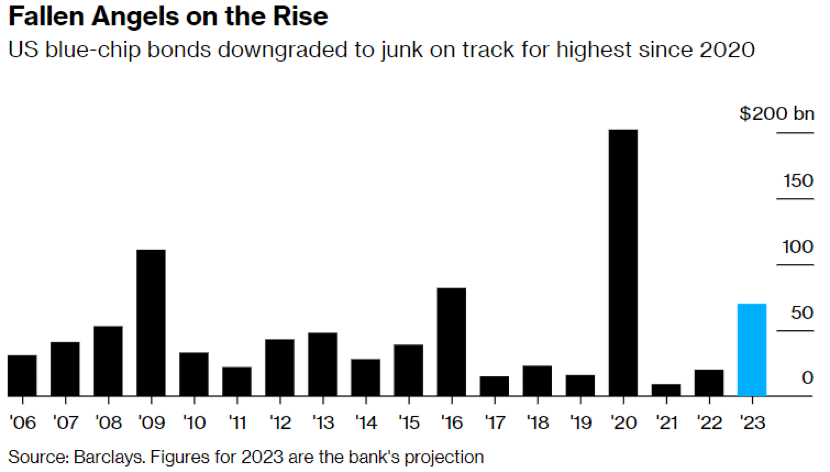

The UK and the Euro-zone were major buyers of US Treasuries, while Japan and Korea pulled money out of the market ‘unwillingly’ and China continued to cut holdings.

We believe, in the second quarter, international capital inflows into the US will further slow down, and foreign purchases may even register net decreases.

Influenced by the recent banking crisis, investors’ expectations for the US 10-year Treasury yield for the next three months should move downward, but the mainstream opinions will still be for it to fluctuate within 3.4%~3.6%.

According to the Treasury International Capital report, at least 16 countries sold US Treasuries in January this year, including China, Belgium, Luxembourg, Ireland, Brazil, France, Saudi Arabia, Germany, Mexico, Israel, Kuwait, Colombia, Sweden, the Bahamas, Vietnam and Peru.

This trend reflects the growing recognition of the adverse effects of the debt-based economic model of the US. The monetary authorities of various countries are now well aware of the unreliability of the US debt being a core asset backing the US dollar.

And the trend is also in line with our predictions made back on October 18, 2022, which says that “the Federal Reserve’s aggressive rate hikes and the rapid appreciation of the US dollar will further accelerate some countries’ de-dollarization and process of getting out of US treasuries.”

US dollar eaponized in the global financial market

The US non-farm payroll data for March released on April 7, 2023, was better than expected and showed the labor market to be resilient.

Meanwhile, the CPI (consumer price index) report released on April 12 showed inflation slowed again.

Although the market’s concerns over the vulnerability of the US Dollar Index increased, considering that economic activity is at a reasonable level and inflationary pressures subsided, we believe the Fed’s tightening monetary cycle might be close to the end.

Previously, the Fed’s aggressive tightening policy has resulted in huge capital inflows, leading to a global US dollar crunch. While the USD dollar crunch intensified, it did not lead to liquidity risks.

And in the first quarter of 2023, global capital flows into dollar-denominated assets have slowed.

Therefore, we believe the US Dollar Index might drop to the lowest level within the year in the coming weeks and remain sideways afterward.

Most importantly, the Russia-Ukraine war has made it clear to people in the US dollar system that US dollar reserves can be frozen by the US.

The gradual uncoupling from the US dollar and multi-polarization will be the trend in the global financial market.

If the importance of the US dollar system declines, its competitors will become more important and at least one strong currency will emerge.

Conclusion BTC is on the way back to above $32,000

We believe as some countries’ fiat currencies collapse due to debt crisis, BTC will demonstrate its power to challenge the incumbent debt-based financial system.

As long as the debt size keeps increasing, BTC will command an increasingly larger proportion as a source of capital in the debt recycling pool.

In the second half of 2023, we predict that BTC will rise to above $32,000, thanks to the following catalysts.

- A slowdown in inflation

- Mitigation of energy issues

- Ceasefire in the Russia-Ukraine war

- The reverse of the M2 supply trend

The above factors will collectively drive the beginning of a new bull cycle. We believe consumers will gradually see Bitcoin as a store of value and a hedge against M2 inflation instead of a direct hedge against CPI inflation.

Particularly in the middle regions of emerging markets that are fraught with frictions from multi-polarization, BTC will become one of the perfect natural alternatives for US dollar dominance.

Meanwhile, if the US economy falls into a recession in one of our expectations, the Fed will probably halt rate hikes and there will continue to be an oversupply of money and deficits in government budgets.

We maintain the view expressed in our last year’s article that the YoY growth of CPI might drop to below five percent by the middle of the year while the unemployment rate might continue to rise, providing the Fed with the best reasons to stop rate hikes.

This round of global dollar crunch exposed inherent defects in the incumbent international monetary system.

Combined with the influence of geopolitical factors, we believe it will facilitate the move towards a multi-polarized international monetary system.

As competitors of the US dollar system have less power and discretion than the controller of the US dollar system, the possibility of their fiat currencies being weaponized by a few authoritarian politicians is fundamentally eliminated.

In this context, Bitcoin’s narrative as a fully stateless currency makes it a more reasonable choice. The large-scale adoption of Bitcoin will significantly lower the possibility of conflicts among political interest groups.

In summary, we believe we are at a critical turning point in the economic cycle, and while the Fed focuses all its attention on managing economic growth and inflation, it will face even greater challenges when unpredictable crises occur in the economy.

In that situation, if there is no particular negative news for cryptocurrencies, BTC will be able to return to above $32,000.

Kyle Liu is the investment manager at Bing Ventures and a seasoned crypto analyst and writer. He provides insightful analysis and research on a wide range of topics including market trends, sector analysis and emerging projects. He is especially strong at providing forward-looking analysis on DeFi related topics.

Follow Us on Twitter Facebook Telegram

Check out the Latest Industry Announcements

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong/Natalia Siiatovskaia

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://dailyhodl.com/2023/05/04/q1-2023-market-review-will-bitcoin-rise-against-the-us-dollar-and-back-to-above-32000/