The crypto community embraced the news that PayPal, the $70B payments firm, was rolling out an Ethereum-based stablecoin, predicting that the company’s brand and vast user base would serve as a boon to crypto markets.

Three weeks later, PYUSD is driving less than $10,000 in daily volume, and data from Nansen shows that only a handful of wallets hold more than a thousand dollars worth of the token.

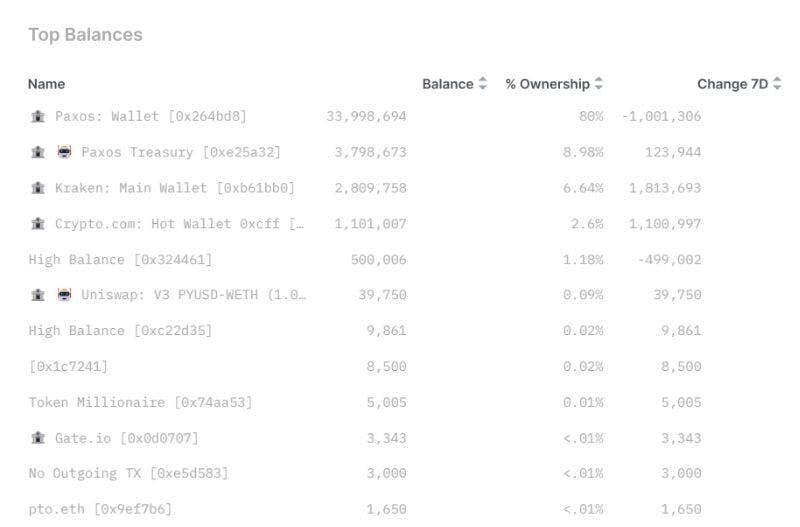

DeFi users in particular are avoiding PayPal’s stablecoin, with the largest non-exchange wallet holding $500,006 PYUSD, followed by just $9,861 and $8,500. Only $39,750 PYUSD are held in Uniswap liquidity pools.

“Very few people are currently using and holding PYUSD in their self-custody wallets,” Nansen said. “On the surface, there’s a lack of demand from crypto users for PYUSD when other alternatives exist.”

Paxos, PYUSD’s issuer, holds 89% of the circulating supply, followed by centralized exchanges Kraken and Coinbase with 6.6% and 2.6% respectively. Just 10 wallets currently hold more than 3,000 PYUSD tokens.

On Aug. 7, PayPal said that U.S. users with a PayPal Balance account would be able to purchase, spend, and trade PYUSD within “the coming weeks,” meaning PYUSD’s poor adoption is not a result of users being unable to access it.

Tether Dominance Rises

Yet PayPal may not be deterred by the indifference of DeFi-natives towards PYUSD.

According to an Aug. 29 report from Binance, centralized tokens make up 92% of the $124.4B combined stablecoin capitalization, with market makers operating on centralized exchanges among the asset’s largest adopters.

PayPal is likely seeing an opportunity to step in with the decline of USDC and BUSD. USDC supply is down 40% following heavy redemptions since depegging in March, while BUSD’s capitalization has crashed 87% since New York regulators ordered Paxos to stop issuing the token in February.

Tether’s market cap is up 23% over the past 12 months, now comprising two-thirds of the stablecoin market. However, Tether’s shadowy past and shifting reserve assets may deter some virtual asset service providers seeking the blessing of regulators from embracing the token, creating opportunities for the likes of PYUSD to claim market share.

The market cap of decentralized stablecoins took a hit following the collapse of Terra’s UST token last year, further receding alongside a 56% drop in DAI’s market cap since the start of 2022, according to CoinGecko.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://thedefiant.io/paypal-stablecoin-sees-minimal-activity-three-weeks-after-launch