As a Bitcoin trader, the risks but also rewards are quite high, making it a captivating endeavor for those willing to delve into the world of digital currency trading. Bitcoin’s unique combination of volatility and potential for significant returns has captured the attention of traders globally. In this comprehensive guide, we will explore how to trade Bitcoin effectively, ensuring you are well-equipped with the knowledge to navigate this dynamic market. From the basics of Bitcoin trading strategies to identifying the best platform to trade Bitcoins, we will cover it all.

What Is A Bitcoin Trader?

A Bitcoin trader is an individual who participates in the cryptocurrency market by buying and selling Bitcoin with the aim of making a profit. Unlike long-term investors who may hold assets for longer periods, Bitcoin traders often engage in more frequent transactions. This can range from long-term positions, where they hold Bitcoin with the expectation of price appreciation, to a short-term day-trade, where they capitalize on the market’s volatility.

Being a Bitcoin trader involves a deep understanding of the market trends, analysis of technical and fundamental indicators, and an ability to make informed decisions based on current market conditions. Successful Bitcoin traders use various strategies like day-trading, scalping, swing trading, and position trading, each requiring different skill sets and levels of market engagement.

Moreover, being a Bitcoin trader means staying updated with the latest news and developments in the cryptocurrency world, as these can significantly impact market prices. Also, risk management is a crucial aspect of trading Bitcoin, as the market is known for its rapid price fluctuations.

Why Trade Bitcoin?

Trading Bitcoin has become increasingly popular for several compelling reasons. Firstly, Bitcoin offers exceptional volatility, which, while risky, provides unique opportunities for substantial profits. Secondly, Bitcoin operates 24/7, unlike traditional stock markets. This round-the-clock trading allows traders to react immediately to market news and global events.

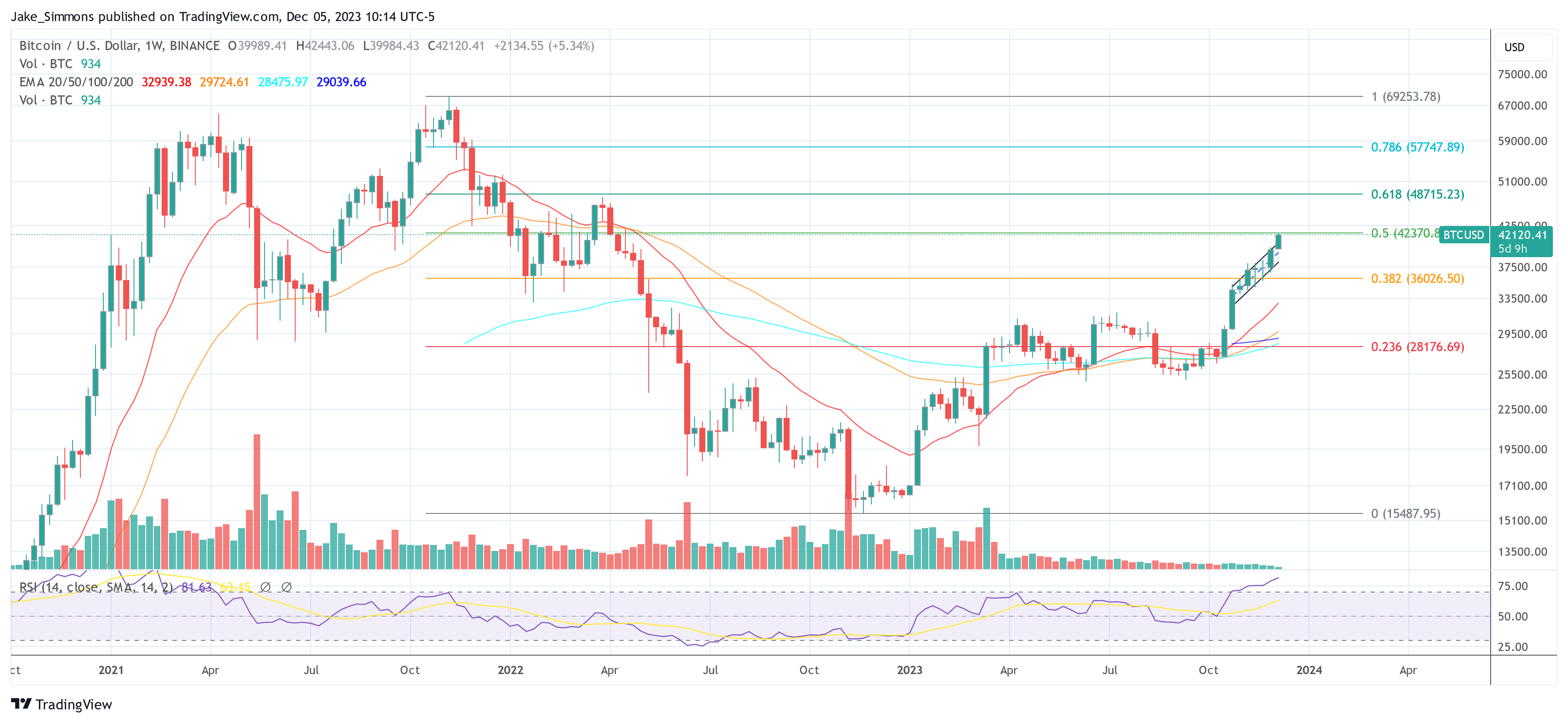

Another reason to trade Bitcoin is its potential for high returns. Bitcoin has shown a remarkable ability to increase in value over time, outperforming traditional investments over the past more than 14 years (since inception). Traders who can skillfully navigate the market’s ups and downs stand to gain significantly.

Bitcoin’s decentralized nature also offers a degree of freedom from traditional financial institutions. This independence from central banks and governments appeals to traders who seek alternatives to traditional financial systems.

Additionally, the increasing mainstream acceptance and adoption of Bitcoin by large companies like MicroStrategy or financial service providers like BlackRock, Fidelity and Invesco have added legitimacy to its trading. As more people use and invest in Bitcoin, its market grows, providing more trading opportunities and liquidity.

How To Trade Bitcoin: Everything You Need To Know

Trading Bitcoin effectively requires a solid understanding of the market and a well-thought-out strategy. The process begins with setting up a trading account on a cryptocurrency exchange or platform. Once your account is set up and funded, you can start trading. Here’s a basic overview:

- Market Analysis: Before any trade, it’s crucial to analyze the market. This involves studying price charts, understanding market trends, and keeping up-to-date with the latest news that could impact Bitcoin’s price.

- Choosing A Trading Strategy: Depending on your goals and risk tolerance, choose a trading strategy that suits you best. This could be day trading, swing trading, scalping, or long-term investing.

- Risk Management: Decide on your risk tolerance and set stop-loss orders to limit potential losses. Effective risk management is key to sustainable trading.

- Executing Trades: Based on your analysis and strategy, buy or sell Bitcoin. This can be done through market orders (buy/sell at current price) or limit orders (buy/sell at a predetermined price).

- Monitoring And Adjusting: Continuously monitor the market and adjust your strategies as needed. Bitcoin’s market can change rapidly, and flexibility can be a significant advantage.

- Learning And Evolving: Always be open to learning. The Bitcoin market is constantly evolving, and staying informed is crucial for successful trading.

Bitcoin Trading Strategies

When it comes to trading Bitcoin, employing the right strategy is crucial for success. Each trader’s approach may vary based on their risk appetite, investment size, and trading goals. In this section, we’ll introduce various Bitcoin trading strategies that are commonly used in the market.

Day-Trade Bitcoin

Day-trading Bitcoin is a fast-paced strategy focused on taking advantage of Bitcoin’s short-term price movements within a single trading day. It requires a deep understanding of market trends and the ability to quickly interpret technical analysis, including chart patterns and trading indicators.

Success in day trading hinges on prompt decision-making and expert-level knowledge of chart patterns and technical indicators.. Effective risk management is vital, with strict adherence to stop-loss orders to mitigate potential losses. Day traders must also stay constantly informed about market conditions and news to make timely, informed decisions.

Bitcoin Scalping

Bitcoin scalping is a meticulous trading approach where traders capitalize on minute price fluctuations in the Bitcoin market. This strategy involves making numerous trades over short periods, sometimes just a few minutes, to accumulate small but frequent profits.

Scalping demands an exceptional level of market analysis, precision, and quick execution. Scalpers must stay intensely focused, often dedicating several hours to monitoring market movements closely. They rely heavily on technical analysis tools and real-time data to identify profitable trade opportunities, using different scalping strategies.

Due to the high frequency of trades, managing fees and maintaining a disciplined approach to avoid significant losses is crucial in Bitcoin scalping.

Swing Trading

Swing trading in the Bitcoin market involves holding positions for several days or weeks to capitalize on expected directional moves or price ‘swings’. This strategy requires a blend of fundamental and technical analysis to predict potential price movements.

Swing traders focus on larger price movements than day traders, allowing for a more relaxed trading pace. The key to success in swing trading is identifying trends and momentum in Bitcoin’s price, which often involves understanding market sentiment and macroeconomic factors influencing the cryptocurrency market.

Bitcoin traders who utilize this strategy need to be patient, as holding positions for longer periods can mean enduring some volatility. However, this strategy can yield substantial returns if market trends are accurately anticipated.

Bitcoin Position Trading

Position trading in Bitcoin is a long-term strategy where traders hold their positions for extended periods, often weeks, months, or even years. This approach is less about the short-term fluctuations and more about the long-term growth potential of Bitcoin.

The Bitcoin traders base their decisions on extensive fundamental analysis, considering factors like market trends, upcoming technological developments, and potential regulatory changes in the cryptocurrency landscape. Unlike day trading or scalping, position trading requires less time dedicated to frequent market monitoring but demands a thorough understanding of the broader economic and technological factors affecting the market.

Patience and a strong belief in Bitcoin’s long-term potential are essential for position trading, as it involves weathering short-term market volatility with an eye on long-term gains.

Step-By-Step Guide: How To Trade Bitcoin

Trading Bitcoin can seem daunting at first, but by following a structured approach, you can navigate the market effectively. Here is a step-by-step guide to help you start your Bitcoin trading journey:

- Educate Yourself: Before diving into trading, it’s crucial to familiarize yourself with the basics of blockchain technology, Bitcoin, and its historical market trends.

- Choose A Reliable Trading Platform: Select a reputable Bitcoin exchange or trading platform. Look for platforms with strong security measures, user-friendly interfaces, and reasonable fees. Consider factors like liquidity, available trading pairs, and customer support.

- Set Up And Secure Your Account: Create your trading account. Ensure you use strong passwords and enable all available security features like two-factor authentication.

- Deposit Funds: Fund your account with fiat currency, which you can then use to buy Bitcoin.

- Develop A Trading Strategy: Decide on your trading style (day trading, swing trading, scalping, or position trading). Consider your risk tolerance and set clear goals.

- Conduct Market Analysis: Use both technical and fundamental analysis to inform your trading decisions. Stay updated with the latest Bitcoin news and market trends.

- Start Trading: Begin with small trades to get a feel for the market. You can either place market orders (buy/sell at current prices) or limit orders (buy/sell at a predetermined price).

- Monitor Your Trades And Manage Risks: Keep a close eye on your trades. Use risk management tools like stop-loss orders to protect your investment.

- Review And Learn: Regularly review your trading activity and learn from both successes and failures. Adjust your strategies and stay informed about factors that could impact the Bitcoin price.

How To Trade Bitcoin And Make Profit

Achieving profitability as a Bitcoin trader hinges on a nuanced understanding of market dynamics and disciplined strategy execution. Success involves identifying and capitalizing on Bitcoin’s price movements, underpinned by a robust grasp of market trends and drivers.

Key to profiting is the application of advanced technical analysis, incorporating chart patterns and predictive indicators to gauge future price movements. Additionally, astute risk management, characterized by calculated position sizing and the judicious use of stop-loss orders, plays a pivotal role in safeguarding against market volatility.

Seasoned traders often emphasize the importance of emotional discipline, avoiding impulsive decisions driven by market euphoria or panic.

How To Trade Bitcoins For Beginners (Spot Market)

For newby Bitcoin traders, the spot market is an ideal starting point. In the spot market, traders buy and sell Bitcoin for immediate delivery, reflecting real-time supply and demand. The immediate trading activities of traders directly determine Bitcoin’s price in this market. It offers a direct and transparent trading method, with transactions settled instantly at prevailing market prices.

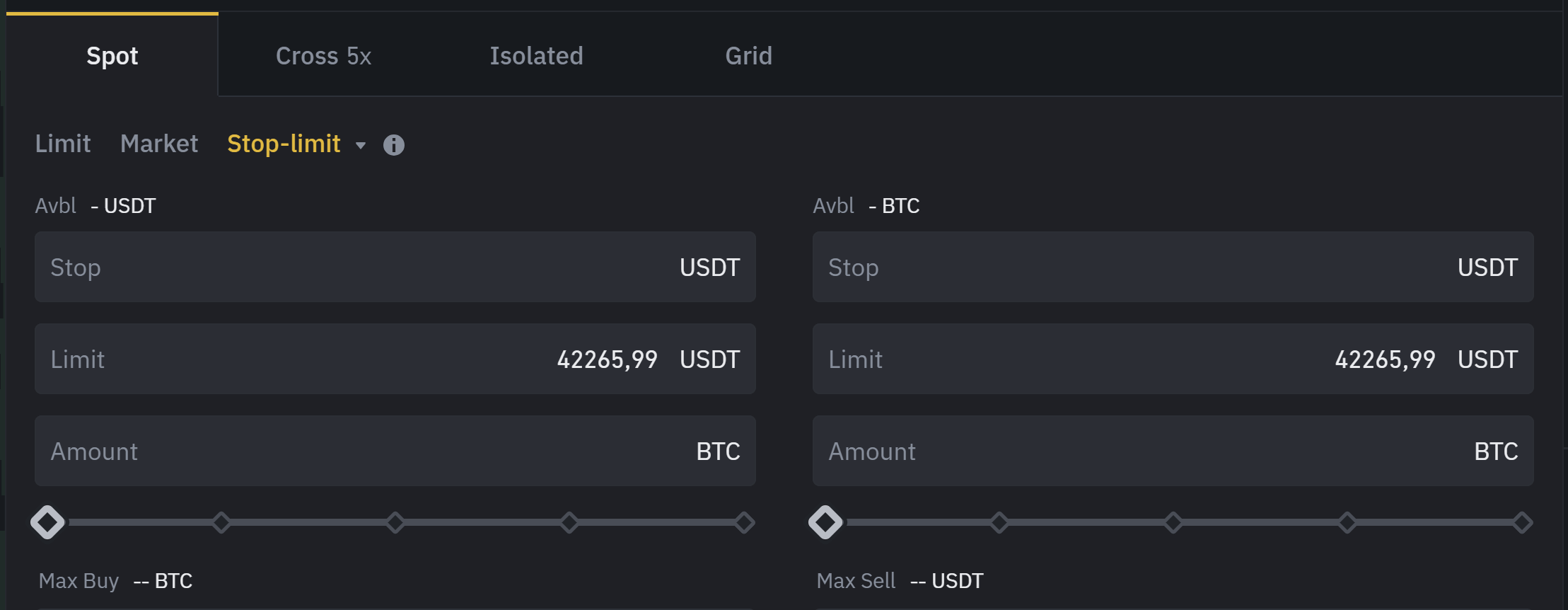

Types Of Orders Explained

- Market Orders: These orders are executed immediately at the current market price. For example, if Bitcoin is listed at $30,000 and you place a market order to buy, you’ll purchase it at the nearest available price to $30,000.

- Limit Orders: These allow you to set a specific price at which you want to buy or sell Bitcoin. For instance, you might place a limit order to buy Bitcoin when its price drops to $28,000, ensuring you only purchase at this price or lower.

- Stop Orders: Often used as a risk management tool, a stop order triggers a buy or sell action once Bitcoin reaches a predetermined price. For example, setting a stop order to sell at $27,000 can help limit potential losses if the market drops.

How To Trade Bitcoins On The Spot Market

Beginners should select trading platforms known for their ease of use, robust security features, and educational resources. Look for platforms with a high reputation and low Bitcoin trading fees.

Navigating the order book can be crucial. The order book is a real-time ledger of all buy and sell orders in the market. It shows the depth of the market, indicating how many orders exist at various price levels. Beginners can use this to gauge market sentiment and potential price movement directions.

Beginners should start with small investments to minimize potential losses. Understand the volatility of the Bitcoin market and be prepared for price fluctuations. Use stop-loss orders to automatically sell your Bitcoin if the price falls to a certain level, thus limiting your loss.

How To Trade Bitcoin Futures

Trading Bitcoin futures primarily involves dealing with perpetual contracts, a distinct type of futures contract without an expiry date. This allows traders to hold positions indefinitely, providing more flexibility compared to traditional futures. Here’s a guide on how to trade Bitcoin futures:

- Understanding Perpetual Contracts: Perpetual futures contracts, unlike traditional futures, have no expiration date, enabling traders to maintain positions indefinitely. This indefinite holding period is counterbalanced by the funding rate mechanism.

- Leverage In Depth: Leverage allows traders to control large positions with a relatively small amount of capital. For instance, with 10x leverage, you can control a position worth 10 times your initial margin. While this can magnify profits, it also amplifies potential losses, making risk management crucial.

- Mechanics Of Liquidation: Liquidation occurs when your position’s value falls to a level where it can no longer support the leveraged amount. For example, in a highly leveraged position, even a small drop in Bitcoin’s price can trigger liquidation, resulting in the loss of your initial margin. It’s vital to understand the exchange’s liquidation process and margin requirements.

- Selecting The Right Exchange: Choose an exchange that offers comprehensive features for trading perpetual Bitcoin futures (e. G. Binance, BitMEX or Bitget), including transparent liquidation protocols, competitive funding rates, and robust platform security.

- Risk Management: Given the high risks associated with leverage, employing effective risk management strategies is essential. Use stop-loss orders to protect your positions, and consider lower leverage levels to reduce the risk of liquidation.

How To Trade Bitcoin Options

Bitcoin options are financial derivatives that give the holder the right, but not the obligation, to buy or sell Bitcoin at a predetermined price before a certain expiration date. Here’s a guide on how to trade Bitcoin options:

Options Types: Understand the two types of options – ‘Call options’ allow buying Bitcoin at a specific price, while ‘Put options’ allow selling it at a set price.

- Strike Price And Expiration Date: Each option has a strike price and an expiration date. The strike price determines the price at which Bitcoin can be bought or sold, while the expiration date marks when the option becomes void.

- Select A Trading Platform: Choose a platform that offers Bitcoin options trading (Deribit is the largest). Ensure it provides adequate security, liquidity, and tools for analysis.

- Premiums: Options are bought for a premium, which is the price paid for the option itself. The premium varies based on factors like the strike price, current Bitcoin price, and time until expiration.

- Market Analysis: Similar to futures, trading options requires a thorough analysis of the market. Predict whether Bitcoin’s price will go up or down before the option expires.

- Risk Assessment: Options can be less risky than futures as the maximum potential loss is the premium paid. However, it’s still important to understand the volatility of the market and to use risk management strategies.

- Strategic Use: Options can be used for various strategies, from straightforward speculation to complex combinations like spreads, straddles, and collars for risk management.

Choosing The Best Platform To Trade Bitcoins

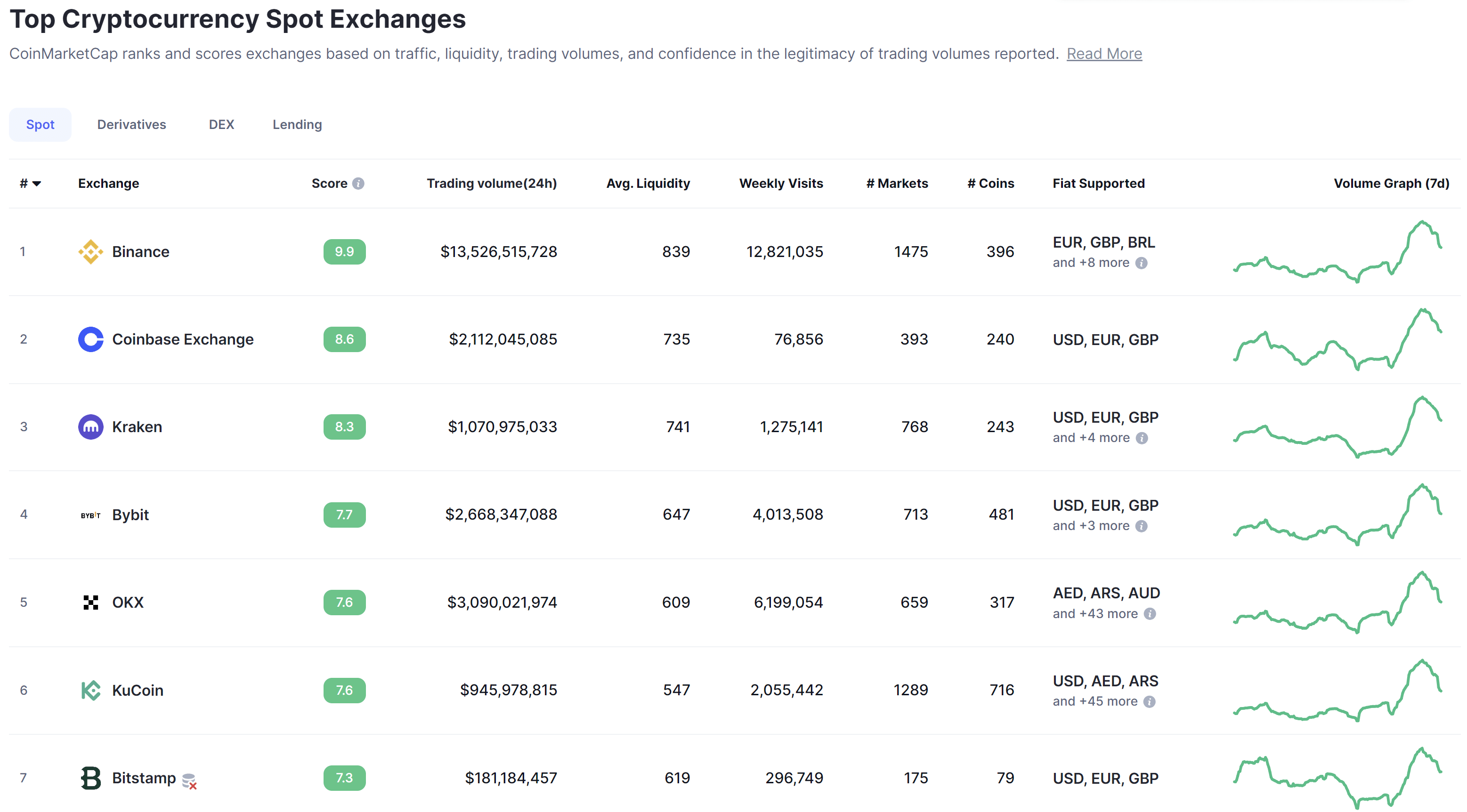

Choosing the best platform to trade Bitcoins requires considering various factors such as security, user interface, fees, liquidity, and available features. Based on the latest data from CoinMarketCap regarding spot trading volume, here are some of the top cryptocurrency exchanges:

- Binance: Known for its high trading volume and extensive list of available cryptocurrencies, Binance offers a robust platform with competitive fees and strong security measures. It supports multiple fiat currencies like EUR, GBP, and BRL.

- Coinbase: Popular especially in the United States, Coinbase is known for its user-friendly interface and strong regulatory compliance. It supports major fiat currencies such as USD, EUR, and GBP, making it a convenient option for traders in those regions.

- Kraken: Kraken is recognized for its comprehensive security features and range of supported cryptocurrencies. It also supports multiple fiat currencies including USD, EUR, and GBP, and is known for its detailed and informative user interface.

- Bybit: This exchange is noted for its advanced trading features and is a popular choice for derivative trading. Bybit supports multiple fiat currencies including USD, EUR, GBP, among others.

- OKX: OKX offers a wide range of cryptocurrencies and is known for its advanced trading features. It supports a variety of fiat currencies including AED, ARS, AUD, and more, catering to a global user base.

- KuCoin: KuCoin is known for its wide array of supported cryptocurrencies and user-friendly interface. It supports multiple fiat currencies including USD, AED, ARS, and more, making it a versatile choice for global traders.

Where To Trade Bitcoin? Key Criteria

Selecting the right platform is a critical step in your Bitcoin trading journey. The best platform for trading Bitcoins not only aligns with your trading style and goals but also offers security, functionality, and reliability. Here are key factors to consider when choosing your trading platform:

- Security: The platform’s security features should be given top priority. Look for platforms with a strong track record of security, utilizing measures like two-factor authentication, encryption, and cold storage of funds.

- User Interface And Experience: The platform should offer a user-friendly interface, especially for beginners. It should be intuitive, with easy-to-use trading tools and accessible customer support.

- Fees And Costs: Understand the fee structure of the platform. This includes trading fees, withdrawal fees, and any other hidden charges. Lower fees can significantly impact your overall profitability, especially if you are engaging in frequent trades.

- Liquidity: High liquidity is essential for executing trades quickly and at desirable prices. A platform with a high trading volume typically offers better liquidity, leading to tighter spreads and more efficient trade execution.

- Range Of Features And Tools: Look for platforms that offer a range of features such as advanced charting tools, a variety of order types, and risk management tools.

- Leverage and Margin Trading Options: If you are interested in trading with leverage, verify the available leverage options on the platform. Be aware that trading with leverage carries higher risks.

- Regulatory Compliance: Choose platforms that are compliant with relevant regulatory standards in your country. This compliance can provide an additional layer of security and legitimacy.

- Market Variety: A good platform should offer a variety of markets, not just Bitcoin.

How To Trade Bitcoin? Key Indicators

Successful Bitcoin trading often hinges on the use of key indicators to make informed decisions. These indicators provide insights into market trends and potential future movements. Here are some essential indicators used in Bitcoin trading:

- Moving Averages: They smooth out price data over a specified time period, aiding traders in identifying the trend direction. The most commonly used are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA).

- Relative Strength Index (RSI): RSI is a momentum indicator that measures the speed and change of price movements. It helps identify overbought or oversold conditions in the market.

- MACD (Moving Average Convergence Divergence): This tool identifies potential buy and sell signals by tracking the convergence and divergence of short-term and long-term moving averages.

- Volume: The trade volume of Bitcoin is a vital indicator of market strength and sentiment. High volumes often signal a strong market interest, either bullish or bearish.

- Bollinger Bands: These bands provide a graphical representation of market volatility. Narrowing bands suggest low market volatility, while widening bands indicate increased volatility.

- Fibonacci Retracement: This tool identifies potential support and resistance levels using Fibonacci ratios derived from price changes.

- Stochastic Oscillator: This momentum indicator compares the closing price of Bitcoin to its price range over a certain period, aiding in identifying potential reversal points.

Trade Bitcoin With On-Chain-Indicators

In addition to traditional technical indicators, on-chain indicators specific to Bitcoin provide deep insights into the underlying blockchain dynamics, helping traders make informed decisions. Glassnode, a leading blockchain data and intelligence platform, highlights several key on-chain indicators:

- Bitcoin Network Hash Rate: Indicates the health and security of the blockchain. A rising hash rate suggests increased network security and miner confidence.

- Active Addresses: The number of unique addresses actively transacting on the network. A growing number of active addresses may indicate increased user adoption and network activity.

- Percent Of Total Supply In Profit: Observing the supply distribution, especially during bear markets, can signal a large-scale supply redistribution. It indicates when the percent of supply in profit for newer buyers surpasses that of long-term holders.

- Realized Profit/Loss Ratio: It tracks whether the aggregate volume of realized profits exceeds that of realized losses. When the 30-day SMA of this ratio returns above 1.0, it indicates a macro trend shift towards profitable on-chain volume.

- aSOPR (Adjusted Spent Output Profit Ratio): This indicator, especially its 90-day SMA, helps identify profitable on-chain spending, indicating broader market profitability.

Combining these on-chain indicators with traditional technical tools offers a comprehensive approach to trading Bitcoin, allowing traders to glean insights from both market sentiment and fundamental blockchain data.

Trade Bitcoin: Risks And Rewards

Trading Bitcoin, like any financial venture, comes with its own set of risks and rewards. Understanding and balancing these aspects is crucial for successful trading.

Managing Risks As Bitcoin Trader

- Volatility: Bitcoin’s price can be extremely volatile, leading to rapid and significant price changes. Managing this risk involves setting stop-loss orders, not overleveraging, and only investing funds you can afford to lose.

- Security Risks: The digital nature of Bitcoin makes it susceptible to hacking and fraud. Use secure trading platforms, enable two-factor authentication, and practice safe storage.

- Regulatory Changes: Bitcoin’s legal status varies by country and is subject to changing regulations, which can impact its value and legality of trading.

- Market Knowledge: Lack of understanding of the Bitcoin market can lead to poor trading decisions. Continuous learning and staying updated with market trends is vital.

The Reward Potential In Bitcoin Trade

- High Return Potential: Bitcoin has seen periods of significant price increases, offering high return potential for savvy traders.

- Market Accessibility: Bitcoin trading is accessible 24/7, offering flexibility and continuous opportunities for traders worldwide.

- Innovative Market: Being part of the Bitcoin market means engaging with cutting-edge blockchain technology, which has the potential to offer new trading opportunities and reshape financial systems.

- Diversification: Bitcoin provides an alternative investment option, which can be a part of a diversified investment portfolio.

FAQ: How To Trade Bitcoin?

How To Day Trade Bitcoin?

Day trading Bitcoin involves executing short-term trades to capitalize on price fluctuations within a single day. It requires a thorough understanding of market trends, technical analysis, and disciplined risk management.

How To Trade Bitcoin and Make Profit?

Profitable Bitcoin trading involves a deep understanding of market trends, utilizing effective trading strategies, and employing robust risk management to mitigate risks while capitalizing on market opportunities.

Where To Trade Bitcoin?

Bitcoin can be traded on various cryptocurrency exchanges and platforms. Popular exchanges include Binance, Coinbase, Kraken, Bybit, OKX, and KuCoin.

How Do You Trade In Bitcoins?

Trading in Bitcoins involves buying and selling on a cryptocurrency exchange, using different trading strategies like day trading, swing trading, or position trading.

Can You Day Trade Bitcoin?

Yes, you can day trade Bitcoin. It involves making multiple trades within a single day, taking advantage of Bitcoin’s price volatility.

How To Trade Bitcoins?

Trading Bitcoins involves choosing a reliable trading platform, analyzing the market, executing trades based on your strategy, and managing your risks.

How To Trade In Bitcoin?

To trade in Bitcoin, set up an account on a cryptocurrency exchange, deposit funds, decide on a trading strategy, and start executing buy or sell orders based on market analysis.

How To Trade Bitcoin Options?

Trading Bitcoin options involves buying or selling options contracts on Bitcoin, predicting future price movements. It requires understanding of options trading and market analysis.

How To Trade Bitcoins For Cash?

You can trade Bitcoins for cash by buying and selling your Bitcoin on a cryptocurrency exchange.

How Do You Trade Bitcoin?

Trading Bitcoin involves analyzing the market, setting up a trade on a cryptocurrency exchange, and managing the trade with proper risk management techniques.

How To Trade Bitcoin Futures?

Bitcoin futures trading involves entering contracts to buy or sell Bitcoin at a future date at a predetermined price. It requires knowledge of futures markets and risk management.

How to Trade Bitcoins For Beginners?

Beginners should start by understanding the basics of Bitcoin, choosing a user-friendly trading platform, practicing with small amounts, and using simple trading strategies on the spot market.

How To Trade Bitcoins For Profit?

To trade Bitcoins for profit, implement a well-researched trading strategy. You also need to manage risks effectively, and stay informed about market trends and news.

How To Trade Bitcoins Online?

Trading Bitcoins online involves registering on a cryptocurrency exchange, depositing funds, conducting market analysis, and executing trades through the platform’s interface.

How To Trade Bitcoins To Make Money?

To make money trading Bitcoins, develop a solid trading strategy, utilize technical analysis, manage risks wisely, and stay adaptive to market changes.

Featured image from Shutterstock

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.newsbtc.com/etoro/how-to-trade-bitcoin/