A healthy retracement in Terra Classic price offers a dip opportunity and the potential for uptrend continuation.

<!–

–>

Published 10 mins ago

The ongoing recovery trend in Terra Classic coin price witnessed a sharp reversal from the $0.00028 High. In just two days, the coin value has plunged 26.6% to reach the current trading price of $0.000206. As the broader market sentiment remains bullish, this retracement could possibly be a minor correction to recuperate the exhausted bullish momentum, should you enter this dip?

advertisement

<!–

adClient.showBannerAd({

adUnitId: “856eec25-5bac-4623-9cc6-5827ff47c238”, containerId: “market-banner-ad-mobile”

});

–>

Also Read: BitMEX Launches Terra Classic (LUNC) Perpetual Contract Following Binance

Key Levels to Watch as LUNC Enters Correction Mode

- A bullish crossover between the 100-and-200-day EMA could reinforce the long-term recovery sentiment in the market

- The falling LUNC price could find demand pressure at the $0.000195 and $0.000167 support levels.

- The intraday trading volume in the LUNC coin is $575 Million, indicating a 41% loss.

Over the past two weeks, the Terra Classic price has emerged as one of the standout performers in the crypto market. Starting from $0.0000685 in late November, the coin soared to a 13-month high of $0.00028, achieving a remarkable 305% growth.

However, it has since retreated from this peak to reach $0.000208, currently seeking support near the 38.2% Fibonacci Retracement Level. Such corrections are common following strong rallies and are often seen as a healthy reset for further upward movement.

Thus, the LUNC holders should monitor the $0.000195 and $0.000167 support levels, corresponding to the 38.2% and 50% Fibonacci retracement levels, respectively. Maintaining these supports could signal a possible bounce back and continuation of the recovery trend.

A bullish breakout above the $0.00028 resistance could extend the rally by another 33% to reach approximately $0.0037 in the following month.

Conversely, a fall below the 50% Fibonacci level might indicate a weakening in the buyer’s conviction.

LUNC vs BTC Performance

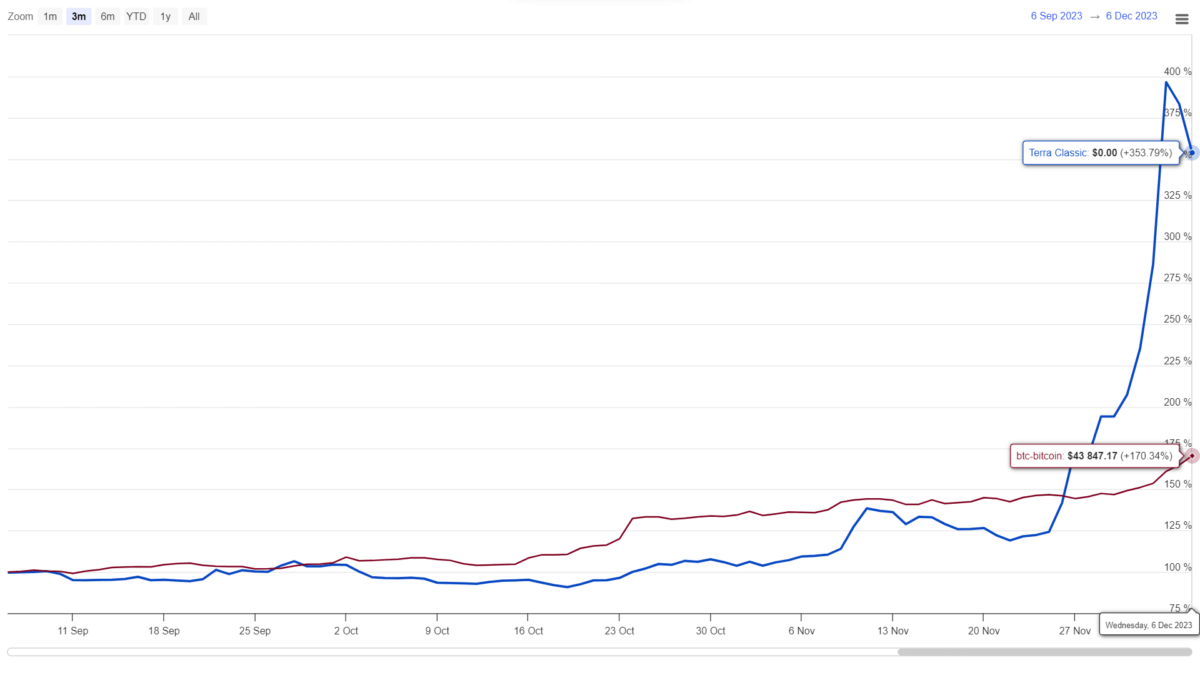

Comparing Terra Classic performance over the last three months with Bitcoin, LUNC has notably outperformed BTC, particularly gaining additional momentum in late November. While Bitcoin price has shown steady, gradual growth, this altcoin’s more volatile pattern may appeal more to aggressive traders looking for dip-buying opportunities, as it has exhibited a pattern of retracing between 50-61.8% before its next upward move.

- Average Directional Index: The daily ADX slope at a high of 55%, accentuates the exhausted position and need for a minor pullback.

- Exponential Moving Average: The rising 20-day EMA slope could offer additional support amid the current pullback.

advertisement

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

<!– Close Story–>

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://coingape.com/markets/is-it-the-best-time-to-enter-luna-classiclunc/