Learn what Bitcoin halving is and how to account for this event in your trading strategies in the weeks and months to come

Executive Summary

- The upcoming Bitcoin halving will decrease the issuance of new BTC from 900 to 450 per day, directly affecting the supply side of Bitcoin’s economy. Understanding this event’s implications within the broader market context, including other influential factors such as Bitcoin ETFs, is essential for traders navigating this landscape.

- Halving historically influences Bitcoin’s value and market cycles and must be accounted for in trading strategies, especially for momentum and trend traders. Tools like Glassnode’s data and analytics provide vital insights for navigating pre and post-halving market volatility.

- The halving introduces volatility in mining profitability and hashprice fluctuations, affecting Bitcoin mining company valuations. Operational efficiency and the adoption of advanced technology become crucial for post-halving success.

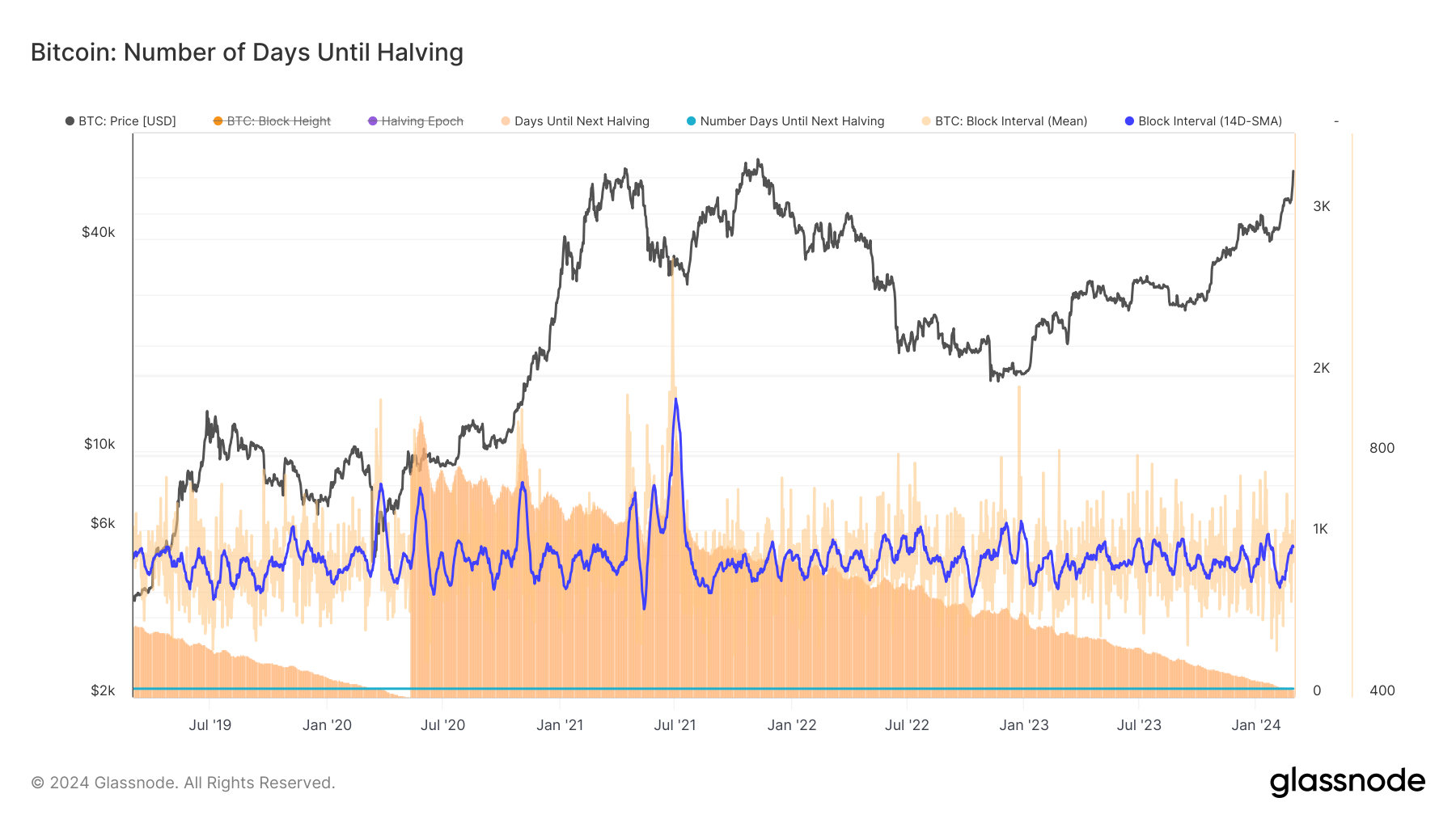

With the Bitcoin halving event about 50 days away, anticipation is building among traders and investors for what is undeniably one of the most significant events in the digital asset world. This mechanism, hard-coded into Bitcoin’s protocol and designed to halve the issuance rate of new coins, is expected to have both immediate and long-term consequences on the available supply and valuation.

The market is already reacting, with Bitcoin’s price surging more than 40% in the last four weeks, as traders gear up for potential shifts in market dynamics. For directional traders of Bitcoin or Bitcoin-related equities, understanding halving and its anticipated effects is crucial for navigating the trading landscape in the months ahead.

For entities trading, understanding the halving is critical due to its impact on:

- Scarcity: Halving reduces the new Bitcoin supply, reinforcing its scarcity and likely affecting the supply of Bitcoin directly available for trading.

- Market cycles: Historically, halvings precede bull markets, indicating a potential uptick in value post-event.

- Increased demand: With Bitcoin ETFs raising demand, the halving’s market impact could be magnified.

- Profitability: The event affects mining profitability and, by extension, the financial outlook of related companies, influencing stock evaluations.

Accounting for these effects, especially the halving’s influence on supply scarcity and its historical relationship with market cycles, is essential for developing effective momentum and trend trading strategies in the following weeks and months.

Bitcoin’s Economic Model

Bitcoin’s economic model is designed to mimic the scarcity and value preservation seen with precious metals, such as gold. Just as the supply of gold can increase through the mining industry and processes – which use people, equipment, and energy – more Bitcoin is created in a process called mining.

However, instead of physically digging into the earth, “miners” use powerful computers to solve complex mathematical puzzles. This digital mining process adds new “blocks” (bundles of Bitcoin transactions) to the “blockchain,” a public ledger that records all Bitcoin transactions.

For adding a new block to the blockchain, miners receive a reward in bitcoins. This reward is what gets halved approximately every four years or after every 210,000 blocks mined. The reward started at 50 bitcoins per block in 2009 and has since decreased to 6.25 bitcoins as of the last halving in 2020.

Precious metals often become harder to find and mine over time, which affects their supply and price. Similarly, Bitcoin’s mining rewards decrease through halving, making new bitcoins more scarce. This scarcity is central to Bitcoin’s value proposition, aiming to increase or preserve its value over time.

Although mining for precious metals and mining for Bitcoin may share some conceptual similarities, there are also notable differences. In contrast to gold mining, where the discovery of new veins can unpredictably increase the supply, Bitcoin’s issuance is not subject to such variability. Additionally, in the gold market, rising prices can render previously unprofitable seams feasible to mine, further affecting supply. Bitcoin, however, operates on a predetermined and transparent supply schedule, ensuring its issuance remains consistent regardless of market fluctuations. The halving event ensures that the total supply of bitcoins will never exceed 21 million, making Bitcoin a disinflationary asset compared to traditional fiat currencies.

Key Concepts Explained

Miners: Individuals or entities that use powerful computers to process and verify Bitcoin transactions. Their role is crucial for maintaining the blockchain’s integrity and security.

Mining: The process by which transactions are verified and added to the Bitcoin blockchain. It involves solving complex mathematical puzzles that require significant computational power.

Blocks: Digital data structures that store information about transactions. When miners successfully solve a mathematical puzzle, they add a new block to the blockchain, containing recent transactions.

Block Reward: The incentive given to miners for adding a new block to the blockchain. It consists of newly minted bitcoins and transaction fees from the transactions included in the block.

Halving: A predetermined event that occurs every 210,000 blocks, roughly every four years, reducing the block reward by half. It controls the rate at which new bitcoins are introduced to the system, enhancing Bitcoin’s scarcity.

The Impact of Halving on Bitcoin’s Economy

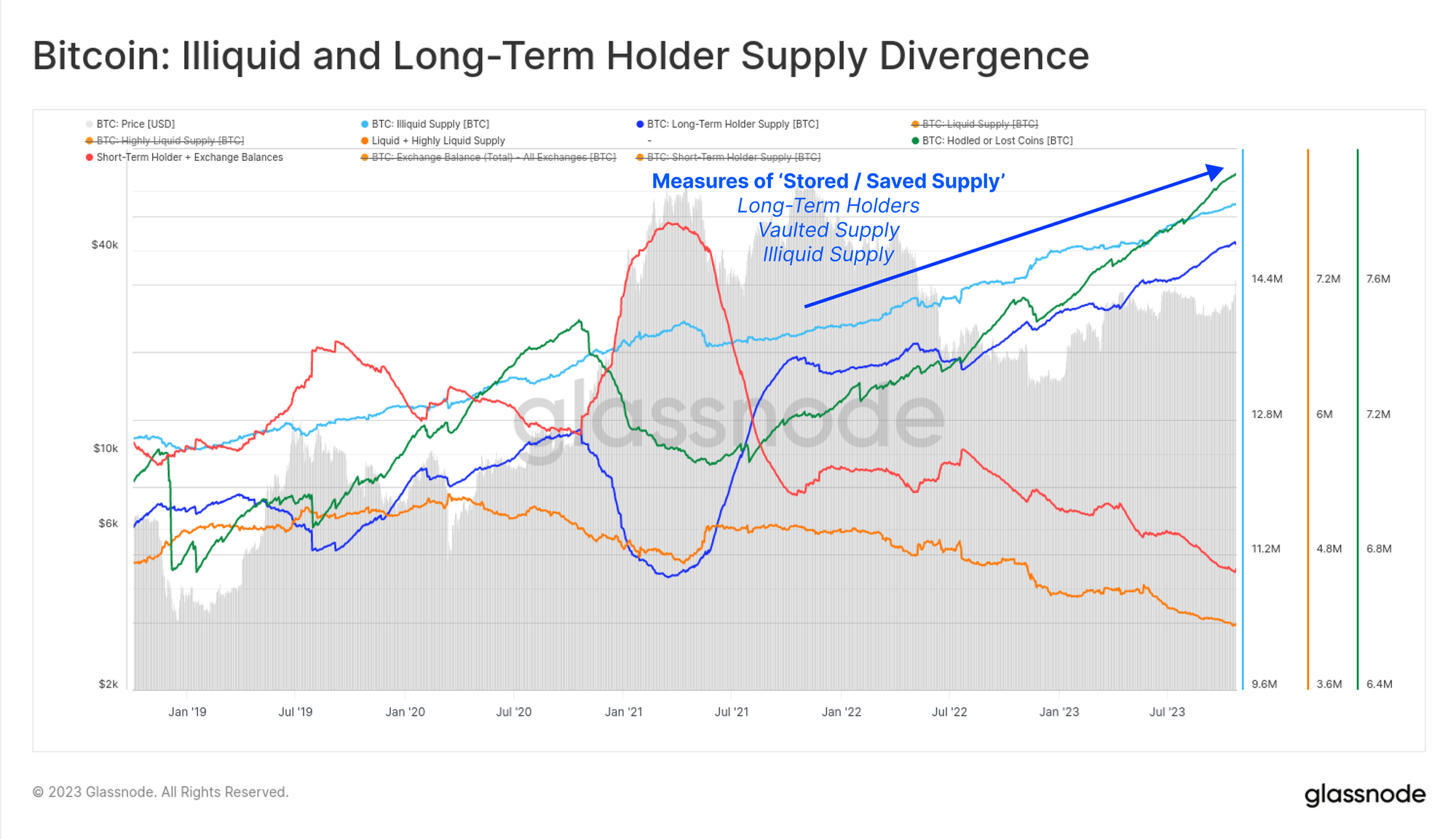

With a little less than 2 months to the fourth halving in April 2024, the supply of Bitcoin immediately available for trading has already reached historically tight levels, with notable effects on the digital assets price action. For example, as Glassnode has highlighted in one of our recent reports, the rate of Bitcoin being locked away for long-term investment already exceeds the new supply by more than 200%. This means that even though new Bitcoin continues to be mined, a larger portion is being held onto by investors rather than being sold or traded.

Additionally, the recent introduction of Bitcoin ETFs has significantly bolstered demand from institutional investors, acting as a major sink for available supply. These ETFs have already absorbed over $9 billion in BTC, underscoring a strong appetite among institutional participants. Given this escalated demand against a backdrop of diminishing new supply, there is a visible potential for upward pressure on Bitcoin’s price.

Additionally, the movement of Bitcoin into long-term storage is accelerating. More investors are holding onto their Bitcoin, moving it away from exchanges and into wallets where it is less likely to be sold in the near term. This behaviour is reducing the active supply of Bitcoin on the market. Currently, the amount of Bitcoin being moved into such long-term storage is increasing at a rate of 180k BTC per quarter, which is double the amount of new Bitcoin being mined. This shift towards holding Bitcoin as a long-term investment is further tightening the supply and could strengthen Bitcoin’s price foundation as the halving approaches.

The Halving and Bitcoin Mining Operations

The Bitcoin mining sector faced a major turnaround in 2023, bouncing back from previous challenges with a boost in Bitcoin’s price, a surge in transaction fees, and a significant rise in network difficulty. This positive shift came in anticipation of a spot Bitcoin ETF approval and was further propelled by the adoption of the ordinals protocol, leading to a 336% increase in transaction fees over the year. The introduction of more efficient ASICs to the market also played a crucial role, contributing to a 104% growth in network difficulty.

As the halving draws near, the Bitcoin mining industry is bracing for significant changes, primarily due to the halving of the block subsidy. This reduction effectively doubles the BTC production cost for miners, presenting a challenge to profitability. While transaction fees paid by users can offset some of this increased cost, they represent a more volatile income stream, adding an element of unpredictability to miners’ revenue.

Additionally, as seen in the chart below, the production costs for the least efficient miners are expected to double to about $66k. This highlights just how important it is for miners to be efficient and adapt to stay in the game. In response to these challenges, miners are adapting by investing in more efficient mining hardware to reduce operational costs.

On the other hand, if the less efficient miners decide to suspend operations due to the rising costs, the remaining active miners could actually see increased profitability. This is because less competition for the same block rewards means a higher chance of earning those rewards for the miners who continue to operate.

Investors in the stocks of mining companies need to consider these factors closely, as they directly impact the valuation of Bitcoin mining companies. For instance, the efficiency of mining operations and their ability to adapt to hashprice volatility will play critical roles in determining profitability post-halving. Additionally, the capacity of these companies to secure and deploy the latest mining technology could significantly affect their market position and financial health, influencing investor confidence and stock performance.

Key Concepts Explained

Transaction Fees: Costs users pay to miners for processing Bitcoin transactions, varying with network congestion.

Network Difficulty: A measure that ensures new blocks are found every 10 minutes by adjusting the complexity of mining tasks.

Ordinals: A method for marking individual satoshis with unique data, like images or text, introducing new uses and demand vectors for Bitcoin.

Hashprice: The expected daily revenue per terahash of mining power, reflecting Bitcoin’s price, transaction fees, and mining difficulty.

Block Space: The limited capacity within a block for transactions, where users bid via fees for their transactions to be included.

Impact on Directional Trading Strategies

For directional traders preparing for the halving, it’s crucial to balance long-term perspectives with short-term tactics. Considering the historical context, halving events have often been followed by periods of price appreciation, which could influence strategies for those with a longer investment horizon. Conversely, short-term traders might seek to capitalize on the volatility surrounding the event, applying Glassnode’s data and on-chain analytics to spot potential entry and exit points.

For example, leveraging Glassnode’s profit and loss indicators can provide more precise insights into the underlying market sentiment, potentially revealing levels at which different groups of investors are incentivised to take profits or add to their holdings.

To help directional traders utilize these metrics effectively, Glassnode has recently published a checklist which offers practical guidance on incorporating our data into trading strategies. This resource, accessible here, can be instrumental in refining strategies and managing exposure to the anticipated market movements following the halving.

Stay Tuned for More Halving-Related Content from Glassnode

This introductory article has laid the groundwork for understanding the halving’s multifaceted effects on Bitcoin’s economy and its market dynamics. Key takeaways include the imminent supply squeeze, the strategic shifts miners must undertake to stay profitable, and the rising institutional interest that signals Bitcoin’s maturation as a financial asset.

With Bitcoin’s supply tightening and institutional demand via Bitcoin ETFs increasing, the halving is poised to have a profound impact on the market. Understanding these dynamics is essential for informed trading and investment decisions, equipping participants to capitalize on the opportunities this event may present.

As the halving approaches, Glassnode will continue to provide analysis and guidance for directional traders focused on this event and its impacts. Upcoming articles will delve further into the halving’s implications and offer strategic insights for directional traders looking to navigate the post-halving Bitcoin trading environment effectively.

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://insights.glassnode.com/bitcoin-halving-directional-traders-guide/