Imagine a small e-commerce startup in South America attempting to expand its business to Europe, only to face exorbitant fees, long processing times, and the frustration of navigating complex international regulations. These challenges are not just minor inconveniences; they are significant obstacles that hinder the growth and prosperity of businesses worldwide.

Unlike traditional banking methods that rely on physical branches, virtual IBANs leverage digital innovation to effortlessly transcend geographical boundaries. In this article, we will learn about the fundamentals of virtual IBANs, and their benefits, and explore how they revolutionize cross-border payments.

Table of contents

Fundamentals of virtual IBANs

What’s an IBAN account?

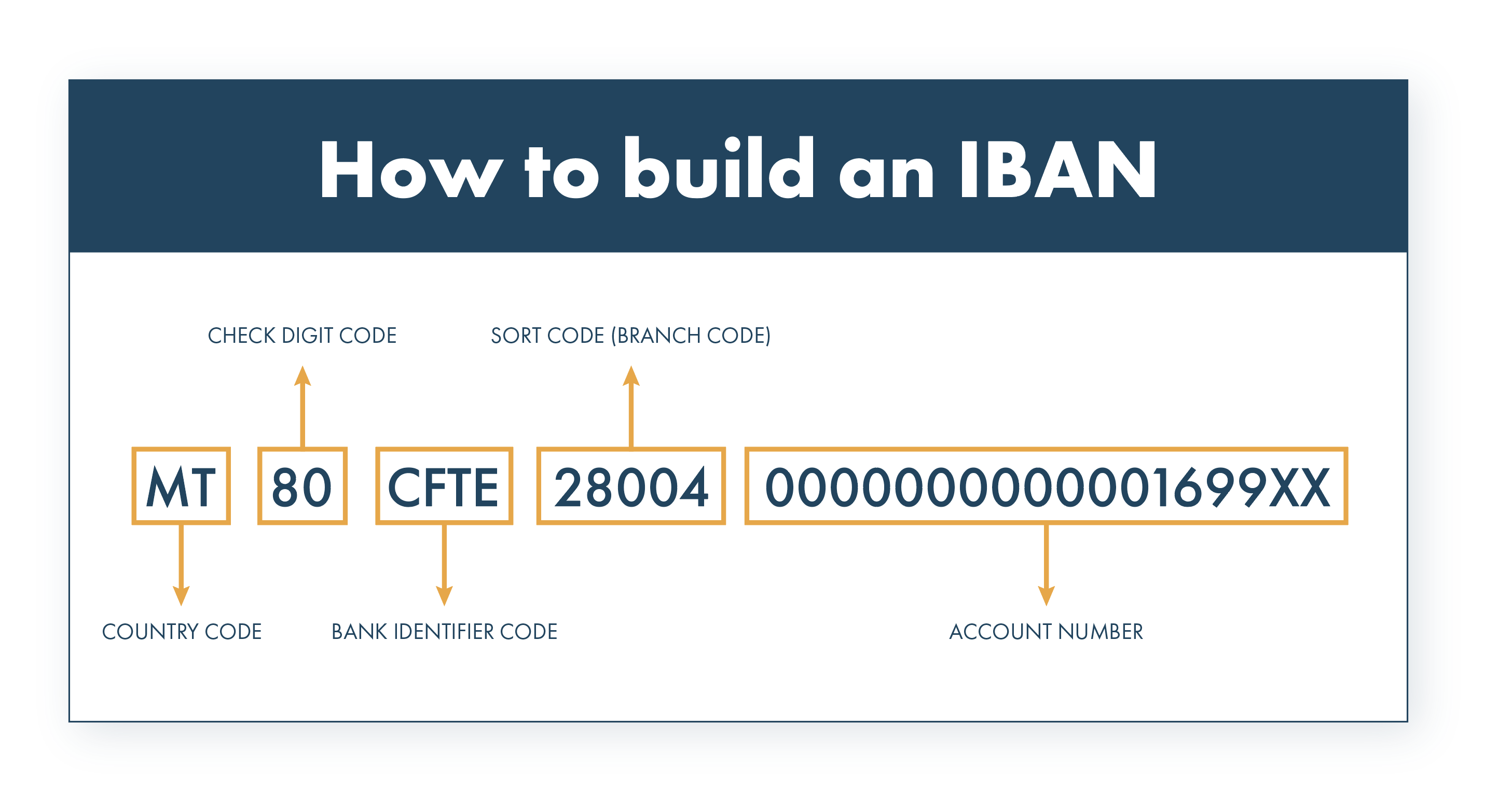

IBAN stands for International Bank Account Number, and it is a standardized system used to identify bank accounts worldwide. It consists of a unique code that identifies a specific bank and a specific account held by that bank. IBANs are used for international money transfers, as they help to ensure that the funds are sent to the correct bank account, in the correct country.

What is the difference between virtual and traditional IBANs?

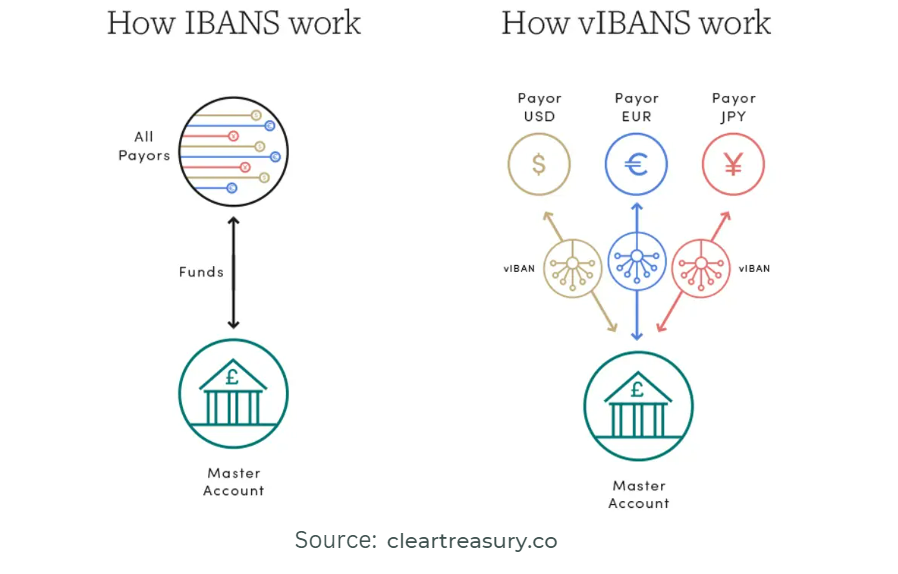

A virtual IBAN or vIBAN is similar to a regular IBAN in appearance and function. Both help in routing international payments. However, while a regular IBAN corresponds to only one bank account worldwide and directs all overseas payments to that account, a virtual IBAN holder can have multiple unique vIBANs in various currencies.

These vIBANs send payments to a single pooled account. You can think of a vIBAN as a linked sub-account of a central master account, which enables international payments between financial institutions to be separated, routed, and received efficiently.

How do virtual IBANs work?

Virtual IBANs are a convenient way to manage cross-border transactions. First, financial institutions issue virtual IBANs upon request, creating digital accounts designed for cross-border transactions.

When it comes to routing payments, virtual IBANs use advanced technology to transfer funds quickly and securely. Transactions are initiated through digital platforms, making it easy to move money between accounts regardless of location.

Security is paramount in cross-border transactions, and virtual IBANs take this seriously by implementing robust encryption protocols and authentication mechanisms. With advanced security measures in place, sensitive financial information is kept safe, providing peace of mind for users.

Get your digital wallet product launched months faster

Accelerate the development process with a ready-made SDK.finance Digital Wallet Solutions

Benefits of virtual IBAN account for business

Virtual IBANs offer several benefits over traditional banking methods.

Faster processing time

Virtual IBANs expedite the processing of cross-border transactions, eliminating the delays associated cross-border payments with traditional banking methods. With instantaneous transfers, businesses can capitalize on opportunities without being hindered by bureaucratic red tape.

Reduced fees

By bypassing intermediary banks, virtual IBANs can significantly reduce transaction fees, which allows businesses to allocate their resources more efficiently and maximize their profitability in the global marketplace.

Increased accessibility

Virtual IBAN providers democratize access to cross-border banking services and transactions, empowering individuals and businesses of all sizes to participate in the global economy. Whether it’s an entrepreneur launching a startup or a multinational corporation expanding its operations, virtual IBANs offer equal opportunities for financial growth.

Improved transparency and control over transactions

Virtual IBANs provide users with real-time visibility into their transactions, enhancing transparency and accountability. With comprehensive reporting features and customizable controls, users can monitor their finances closely and mitigate potential risks effectively.

Revolutionizing industries with virtual IBANs

Virtual IBAN providers are leading a revolution in various industries by streamlining cross-border transactions and unlocking new growth opportunities in today’s interconnected world. Let’s explore specific sectors where virtual IBANs are catalyzing transformative changes:

1. E-commerce

Virtual IBANs have become essential tools for e-commerce businesses navigating the complexities of global sales and receiving international payments. With virtual IBAN provider, merchants can seamlessly accept payments from customers worldwide, eliminating the barriers posed by traditional banking methods.

For instance, a clothing retailer based in Italy can effortlessly process payments from customers in the United States, Europe, and beyond, without being encumbered by currency conversion fees or lengthy processing times.

In this scenario, popular virtual IBANs and financial service providers like Wise or Payset provide merchants with virtual accounts equipped with multi-currency capabilities, enabling them to accept payments in various currencies.

Turn the first years of development into the first years of growing your revenue

Explore how our powerful API-driven neobank software can accelerate your launch

2. Freelancing

Freelancers operate in a borderless digital landscape, collaborating with clients across the globe. Virtual IBANs have revolutionized the freelancing industry by facilitating seamless payments between freelancers and clients worldwide.

For example, a graphic designer in India collaborating with a marketing agency in the United Kingdom. By using virtual IBANs, the agency can easily transfer payments to the freelancer’s account in India, ensuring timely compensation and fostering a mutually beneficial partnership.

3. On-demand services

On-demand services rely heavily on international workers to meet the demands of a global customer base. Virtual IBAN providers streamline payouts for international workers, ensuring prompt and secure transactions.

Take, for example, a ridesharing company operating in multiple countries. By using customer data and leveraging virtual IBANs, the company can efficiently disburse earnings to drivers in different regions, enhancing operational efficiency and maintaining driver satisfaction.

The future of cross-border payments

The future of cross-border payments looks promising with the emergence of virtual IBANs. Below we highlight the key benefits of virtual IBANs that are driving this transformation:

- Increased global financial inclusion

Virtual IBANs can break down traditional barriers to banking services, which can significantly enhance global financial inclusion. With cost-effective solutions for cross-border transactions, individuals and businesses in underserved regions can participate more effectively in the global economy. This can empower previously marginalized communities to access opportunities for economic growth and prosperity.

- Rise of borderless commerce

Virtual IBAN providers facilitate seamless cross-border payments, making it easier for businesses to expand their reach into new markets. With geographical boundaries no longer posing impediments to trade and transactions, we anticipate a surge in international trade and collaboration.

Regulatory landscape for IBANs

The regulatory landscape for IBANs can be complex, but it’s important to understand that IBANs are a standardized format for bank account numbers. In order to offer IBANs, a fintech company would need to be authorized to provide banking services. This typically involves obtaining a banking license from the relevant regulatory authorities.

The specific requirements for obtaining a banking license can vary depending on the country and regulatory authority in question. However, the application process generally involves demonstrating financial stability, compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, and other criteria. Fintechs may also need to have a certain level of capital reserves, as well as a team with expertise in banking and compliance.

Once a fintech has obtained a banking license, they can then offer IBANs to their customers, along with other banking services such as payments, deposits, and lending. However, it’s important to note that offering banking services comes with significant regulatory obligations. This includes ongoing compliance with AML/KYC regulations and other financial reporting requirements.

Expand your market with virtual and physical card issuing

Create virtual or physical cards faster via SDK.finance easy-to-use card issuance API

To navigate these regulatory requirements, fintechs can work closely with legal and compliance teams to ensure they are meeting all necessary standards and regulations. They may also invest in technology and infrastructure to support their banking and financial services side, including robust security measures to protect customer data and financial transactions.

By leveraging advanced technology and digital innovation, virtual IBANs offer unparalleled convenience, speed, and transparency in cross-border payments. Businesses and individuals alike are empowered to navigate the complexities of international finance with ease, unlocking new opportunities for growth and prosperity.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://sdk.finance/how-virtual-ibans-are-revolutionizing-cross-border-transactions/