Stablecoins are cryptocurrencies whose values are pegged to an asset, either gold, fiat money like U.S. dollars, or even other tokens.

We already know that it is among the most used cryptocurrencies in the industry. Some use stablecoins for sending money without using traditional remittance platforms, some transfer their assets into stablecoins to play safe from the market’s volatility, and some even use stablecoins for paying gas fees and other transaction fees.

However, stablecoin issuers rely heavily on traditional financial institutions, as every stablecoin normally is represented by an asset reserve on these centralized institutions.

There is a DeFi protocol that believes that decentralized stablecoins need decentralized financial institutions to enable a “truly decentralized financial system.”

Read more: 30+ Potential Crypto Airdrops to Watch Out For in 2024

H/T to Paolo Dioquino of DeFi Philippines BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.

Ethena Introduction

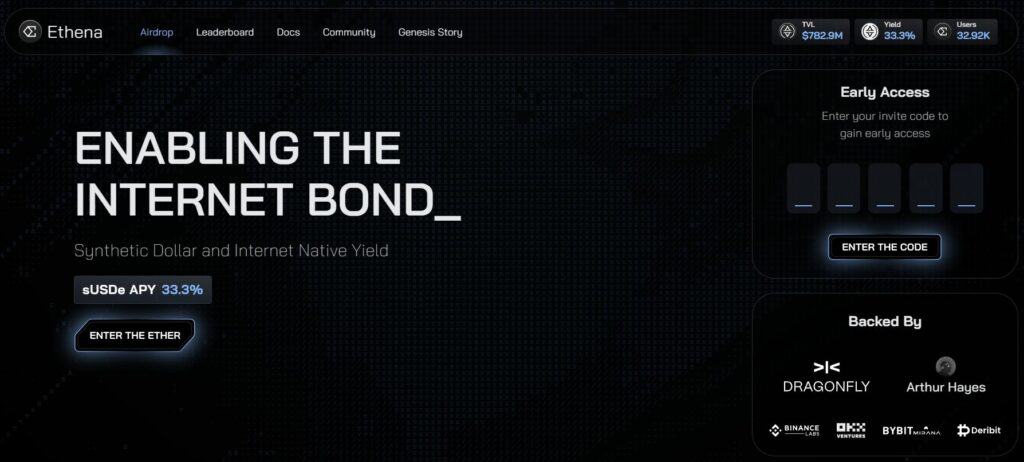

Ethena (https://www.ethena.fi/) is an Ethereum-based synthetic dollar protocol that is seeking to provide a crypto-native solution for money not reliant on traditional banking system infrastructure.

According to the protocol, “overcollateralized stablecoins” are experiencing scalability issues as their growth was inexorably tied to the on-chain growth in leverage demand for Ethereum.

“Lately, some stablecoins have resorted to onboarding Treasuries in an effort to improve scalability, at the cost of censorship resistance,” the team explained.

Ethena $USDe

Ethena then introduced $USDe, a synthetic dollar that aims to provide the first censorship-resistant, scalable, and stable crypto-native solution for money achieved by delta-hedging staked Ethereum collateral.

“Through the use of derivatives on staked Ethereum collateral on deep and liquid centralized venues, USDe aims to directly address both the scalability ‘stablecoin trilemma’ that previous decentralized stablecoins designs have encountered, as well as the custodial risk deficiencies of centralized stablecoins,” the team added. The stablecoin trilemma that it mentions refers to issues relating to scalability, mechanism design, and a lack of embedded yield.

$USDe will be fully backed transparently on-chain and free to compose throughout DeFi, while its peg stability is ensured through the use of delta hedging derivatives positions against protocol-held collateral, as per the Etherea developers.

Moreover, aside from its synthetic dollar product, Ethena is also set to offer a “globally accessible dollar-denominated savings instrument” called the Internet Bond.

It is designed to combine yield derived from staked $ETH as well as the funding and basis spread from perpetual and futures markets, to create the first on-chain crypto-native “bond” that can function as a dollar-denominated savings instrument for users in permitted jurisdictions, the team clarified:

“By focusing on staked Ethereum—the only collateral asset that can provide an uncensorable and trustless native yield at scale—the Ethena protocol addresses all of the aforementioned issues while providing users access to fully custodial and backed stability with an embedded yield inherent to the protocol system. Most importantly, doing so without a dependence on the existing banking system.”

In traditional finance, a bond is a debt security that represents a loan made by an investor to a borrower, usually a corporation or a government. The borrower should pay back the principal amount of the loan at a specified maturity date, as well as interest payments at a fixed or variable rate.

In the Philippines, the Philippine Bureau of Treasury (BTr) issues treasury bonds, which are fixed-interest government securities with a set maturity period. They play a crucial role in funding the executive department’s projects and programs.

Read: Philippines Introduces Blockchain Tokenized Treasury Bonds via PDAX

Ethena Airdrop Guide

Ethena has an ongoing rewards system called the Shard Campaign. This campaign is in line with the public launch of $USDe on February 19, 2024.

Currently on its second epoch, the Shard Campaign will be until May and will will be split across multiple short duration seasons, or “Epochs,” each rewarding different activities involving USDe and other platform features.

How to Join Ethena Airdrop:

- Step 1: Go to https://app.ethena.fi/join.

- Step 2: Connect a wallet. Recommended wallets include MetMask, Binance Web3 Wallet, WalletConnect, Rabby Wallet, and OKX Wallet.

- Step 3: To earn shards, do the activities listed:

- Provide liquidity and lock LP tokens (20x Shards per day)

- Hold USDe YT or LP on Pendle (10x Shards per day)

- Lock USDe (10x Shards per day)

- Buy and hold USDe (5x Shards per day)

- Stake and hold USDe (1x Shards per day)

- Invite people to Ethena (+10% Shards per invite)

Take note that the Shards Campaign also follows a leaderboard system, but it is not yet clear if the number of rewards depends on the ranking.

This article is published on BitPinas: Ethena Airdrop and Protocol Guide

Disclaimer:

- Before investing in any cryptocurrency, it is essential that you carry out your own due diligence and seek appropriate professional advice about your specific position before making any financial decisions.

- BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://bitpinas.com/learn-how-to-guides/ethena-airdrop-protocol/