- The surprise rate cut by SNB has reinforced the bearish momentum of CHF/JPY.

- CHF has weakened across the board against the G-10 currencies; it is the weakest against the EUR.

- Watch the 169.00 key short-term resistance on CHF/JPY with key support coming in at 166.55.

This is a follow-up analysis of our prior report, “CHF/JPY Technical: Potential major bullish trend exhaustion” dated 13 March 2024. Click here for a recap.

The CHF/JPY cross-pair has remained soft as it failed to surpass its 50-day moving average at around 170.00. The previous minor rally from the 11 Mar 2024 low of 167.08 was rejected at the 50-day moving average on 21 March 2024 and reversed sharply to the downside thereafter with a loss of -296 pips/-1.73% in the past three sessions as it printed an intraday low of 167.83 today, 26 March at this time of the writing.

Prior CHF strength has dissipated across the board

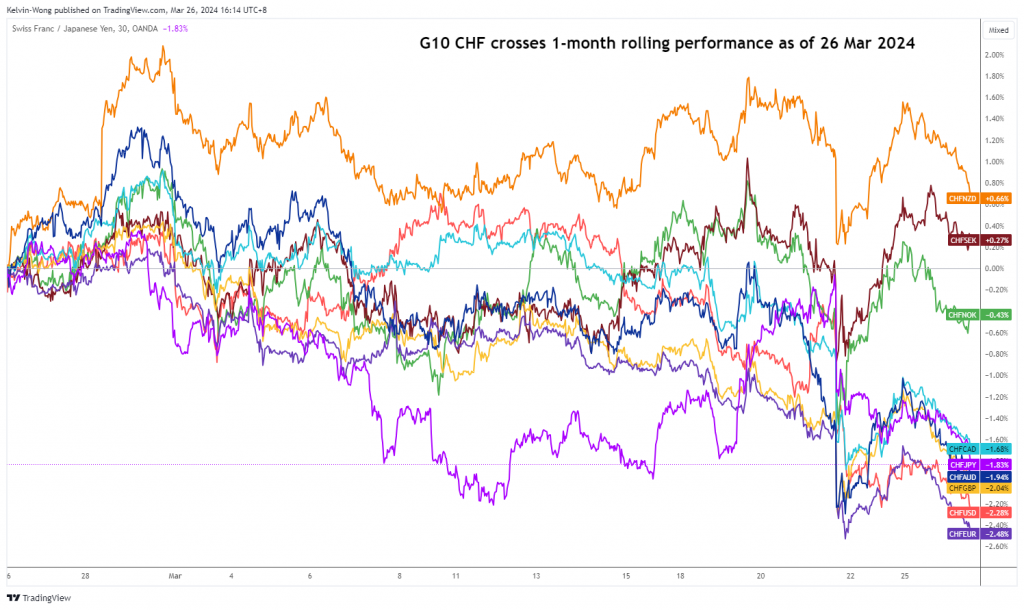

Fig 1: 1-month rolling performances of G-10 CHF crosses as of 26 Mar 2024 (Source: TradingView, click to enlarge chart)

This recent bout of sharp downside reversal of the CHF/JPY has been attributed more to the CHF side of the equation as the Swiss National Bank (SNB) surprised market participants last Thursday, 21 March with a rate cut of 25 basis points (bps) to 1.5% on its key policy rate, its first cut in nine years, and ahead of the US Federal Reserve, Bank of England (BoE), and European Central Bank (ECB).

One of the push factors for enacting an earlier rate cut by SNB is the persistent strength of the franc that could erode the competitiveness of Swiss goods and services which in turn put a dent on economic growth prospects in Switzerland.

The CHF has weakened across the board against other major G-10 currencies and not surprisingly, the CHF is the weakest against the EUR with a loss of -2.5% based on a one-month rolling performance basis with the CHF/JPY coming in fifth position in the pecking order of CHF’s weakness (see Fig 1).

CHF/JPY is looking vulnerable to a major bearish breakdown

Fig 2: CHF/JPY major & medium-term trends as of 26 Mar 2024 (Source: TradingView, click to enlarge chart)

Fig 3: CHF/JPY short-term trend as of 26 Mar 2024 (Source: TradingView, click to enlarge chart)

In the lens of technical analysis, the major uptrend of CHF/JPY in place since the 13 January 2023 low of 137.44 has shown signs of bullish exhaustion. Firstly, it has traced out a bearish “Ascending Wedge” configuration from the 3 October 2023 low where such configuration/chart pattern typically appears at the end of a significant uptrend phase (see Fig 2).

Secondly, medium-term upside momentum has turned lacklustre as depicted by the observations seen in the daily RSI momentum indicator where it has flashed out a persistent bearish divergence condition since 10 January 2024.

Thirdly, the final straw came after the CHF/JPY broke below its 20-day moving on last Thursday, 21 March ex-post SNB.

In the short-term as depicted in its hourly chart, the latest price actions of the CHF/JPY have transformed into a minor downtrend phase after today’s bearish breakdown below its minor ascending trendline from the 11 March 2024 minor low.

If the 169.00 key short-term pivotal resistance (also the 20-day moving average) is not surpassed to the upside, the CHF/JPY may continue to display further weakness to expose the 167.10 near-term support and its key support at 166.55 (the 200-day moving average & lower boundary of the “Ascending Wedge”).

A daily close below 166.55 increases the odds of a major bearish breakdown scenario for the CHF/JPY that is likely to trigger the start of a potential major multi-month downtrend phase.

Conversely, a clearance above 169.00 negates the bearish tone for a choppy minor corrective rebound for the next intermediate resistances to come in at 170.00/20 and 170.70 (medium descending trendline from 22 February 2024 high).

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at [email protected]. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.marketpulse.com/forex/chf-jpy-technical-on-the-brink-of-a-potential-major-bearish-breakdown-chf-weakness/kwong