The total crypto market cap added $82 billion to its value for the last seven-days and now stands at $1.008 trillion. The top 10 currencies showed mixed results for the same time period with Polkadot (DOT) and Chainlink (LINK) adding 83.7 and 34.3 percent to their values respectively while Bitcoin Cash (BCH) erased 21.3 percent. By the time of writing bitcoin (BTC) is trading at $36,433, ether (ETH) is at $1,226. Ripple’s XRP is hovering around $0.284.

BTC/USD

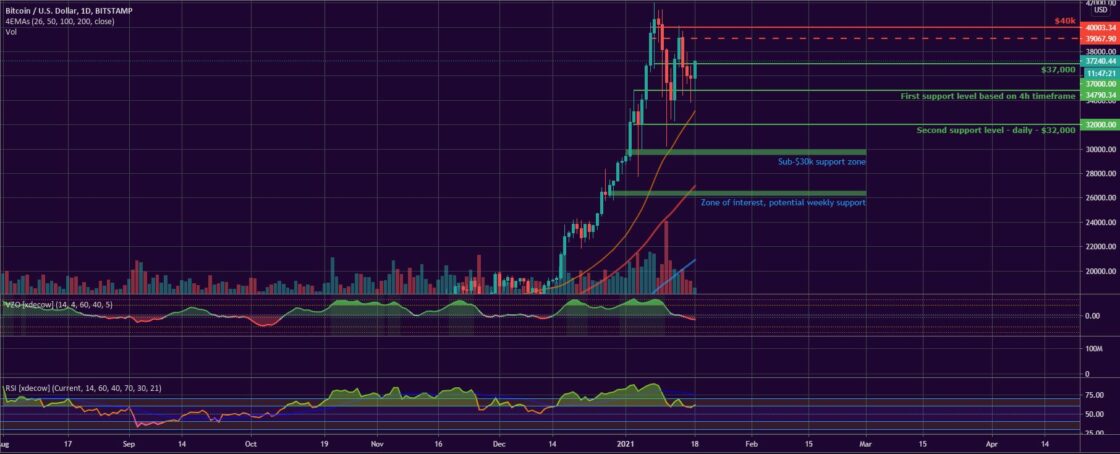

Bitcoin closed the trading day on Sunday, January 10 at $38,169 after losing 5.1 percent of its value. The coin registered a record all-time high two days earlier ($42,073), but failed to consolidate above the $40,000 mark and initiated a pullback. Not only that, but it was seen as low as $34,264 during intraday before partially recovering in the evening.

Still, BTC was 15 percent up on a weekly basis.

The new trading period started on Monday with a fresh drop, this time to $30,258. The move resulted in a 20.7 percent correction at some point during the day, but the quick reaction from buyers reduced it to just 7 percent at the end of the session.

On Tuesday, January 12, we saw the leading cryptocurrency forming the fourth straight red candle on the daily chart and breaking below the first major line of support at $34,700. It stopped at $33,960.

The mid-week session on Wednesday was when the head and shoulders pattern on the 4-hour chart was in its final phase, ready to trigger the next big move downwards. The BTC/USD pair, however, once again took all by surprise and skyrocketed all the way up to $37,408 instead, proving all critics wrong (at least temporarily). It increased by 10 percent.

On Thursday, January 14 the coin hit $40,000, but suffered a hard rejection there, pulling back to $39,177 in the aftermath. It still ended the session with a 4.7 percent increase.

The last day of the workweek came with another highly volatile day during which bitcoin traded in the $39,700 – $34,400 area before erasing all gains from the previous session stopping at $36,700.

The weekend of January 16-17 started with a drop to $36,000 on Saturday, which was followed by a third straight day in red for BTC and a further decline to $35,830 on Sunday.

ETH/USD

The Ethereum project token ETH fell $70 short of reaching its previous all-time high on Sunday, January 10 by hitting $1,354. It failed to keep up with the momentum though and ended the day with a short red candle to $1,254. Actually, the coin was extremely volatile during this entire last session of the week and was jumping up and down in the wide range between the mentioned high and $1,174. It grew by 28 percent for the seven-day period.

On Monday, the ETH/USD pair dropped all the way down to $908 in the morning part of the session then compensated for some of the losses in the afternoon, but still registered a significant correction of approximately 13 percent (closed at $1087).

It resumed its freefall on Tuesday, January 12 by hitting the weekly support at $1,050. The level seemed to help ether stabilize and avoid further losses, and on the third day of the workweek, it changed its direction by climbing up to $1,131.

On Thursday, January 14, the leading altcoin climbed up to the major daily/weekly resistance at $1,235 and added another 9.3 percent to its value. Bears, however, were once again quite active in that area and pushed the price of ETH down to $1,059 on the very next day. The coin recovered later in the evening and closed with a small loss to $1,170.

The first day of the weekend saw the Ethereum token briefly touching $1,297 during intraday before going back to the above-mentioned resistance line.

On Sunday it moved slightly up to $1,235, registering a small gain.

Leading majors

Polkadot (DOT)

Polkadot took the cryptocurrency market by storm last week. The coin added the stunning 85 percent to its value and moved past both Litecoin and XRP to reach the #4 spot with a total market cap of $16.5 billion. The Rococo V1 Update from January 14 might have been the driving force behind the recent rally. The latest version of the parachain (sidechain) testnet enabled even easier access to Polkadot’s services.

Looking at the technical levels, DOT reached an all-time high of $19.4 on Saturday, January 16, and is in price discovery mode for a few days already. A re-trace to $14.5 might be in the cards in case profit taking is triggered. Otherwise, the psychological level of $20 is the next obvious target.

Current price:$17.16

ChainLink (LINK)

LINK also reached a new all-time high on Saturday, January 16 – $23,67 but could not hold it for too long. The general trend for accumulating big-cap altcoins also benefited the blockchain oracles developer, still, it lost few positions in the Top 10 and now sits at #9.

The technical levels we will be looking at upwards are of course $23 then $25. Down we could expect support at the $20-$21 area, then $18.

Current price: $21.92

Altcoin of the Week

Our Altcoin of the week is Curve DAO token (CRV). One of the most promising decentralized finance (DeFi) projects out there (and also one of the most popular since its launch last year), Curve is a decentralized exchange for stablecoins with an automated market maker.

The coin grew by 100 percent for the last seven days and is 125 percent up for the two-week period. CRV now stands at #85 on CoinGecko’s Top 100 chart with a total market capitalization of approximately $293 million. The reason for the recent surge in the price of CRV is most probably the implemented cross-asset swaps between Curve and Synthetix.

This DeFi coin peaked at $.1.75 on Sunday, January 17 and as of the time of writing, this stands at $1.48 against USDT on Binance.

Source: https://btcmanager.com/bitcoin-ether-major-altcoins-weekly-market-update-january-18-2021/