While Binance CEO Changpeng “CZ” Zhao tries to calm crypto Twitter about their financial health and withdrawals, Binance FUD seems to take more time. Binance CEO assures customers that their funds are safe and claims these “stress tests” actually help them build trust in their customers and the crypto community. On-chain data have also indicated no FTX-like behavior. However, uncertainty in the crypto market continues to persist.

On-Chain Data on Binance Crypto Assets

Glassnode on-chain data over the balances held by crypto exchange Binance estimates a total Bitcoin holding of 584.6k BTC. Whereas, Binance declared 359.3k BTC in self-reported Proof-of-Reserves (PoR) wallets. The difference is over 200 BTC, which is seemingly massive. At the current price, it is worth nearly $3.5 million.

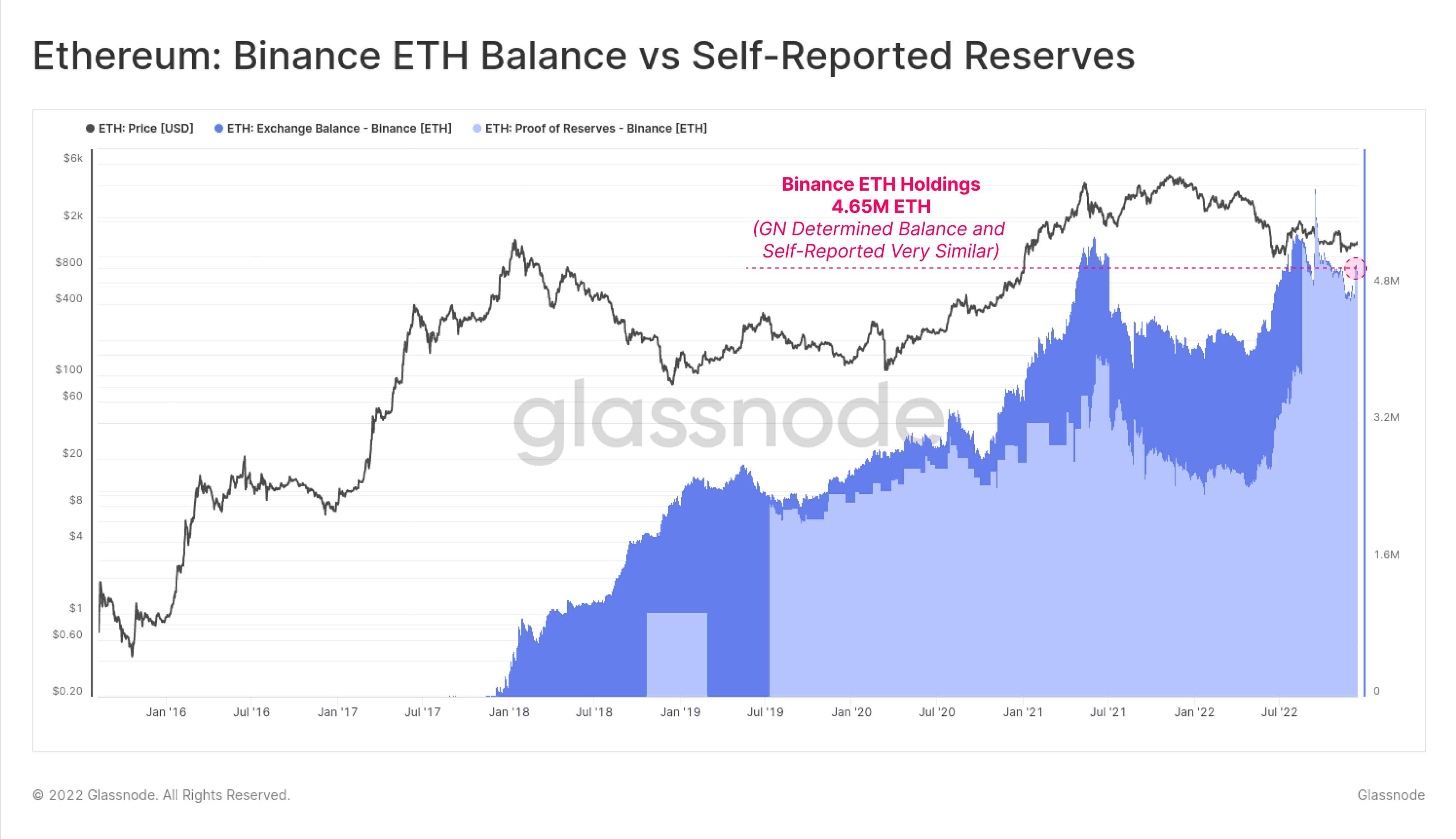

For Ethereum, the on-chain balances reported by Glassnode are the same as those reported by Binance in proof-of-reserves. It is around 4.65 million ETH. Therefore, the same ETH balances reported by Glassnode and Binance’s PoR show the heuristics used are working as the Glassnode team intended.

On-chain data revealed greater volatility in Binance exchange balances through December. This results from the FUD surrounding Binance facing an FTX-like situation which resulted in massive withdrawals of crypto assets by some users.

Binance Bitcoin Deposit and Withdrawal Volume on-chain data indicates significant withdrawals of BTC in the last few days. The exchange recorded the largest net outflow of 57.3k BTC on December 13. During the FTX crisis, the crypto exchange recorded the largest net outflow of 61.4k BTC on November 9

Trending Stories

Meanwhile, the ETH flows on Binance are more stable and relatively ‘typical’ when compared to Bitcoin. Ethereum Deposit and Withdrawal Volume data indicates a large single-day outflow of 456.7k ETH on December 13. It should be noted that the crypto market saw a shift towards self-custody following the collapse of FTX.

On-Chain Stablecoin Data

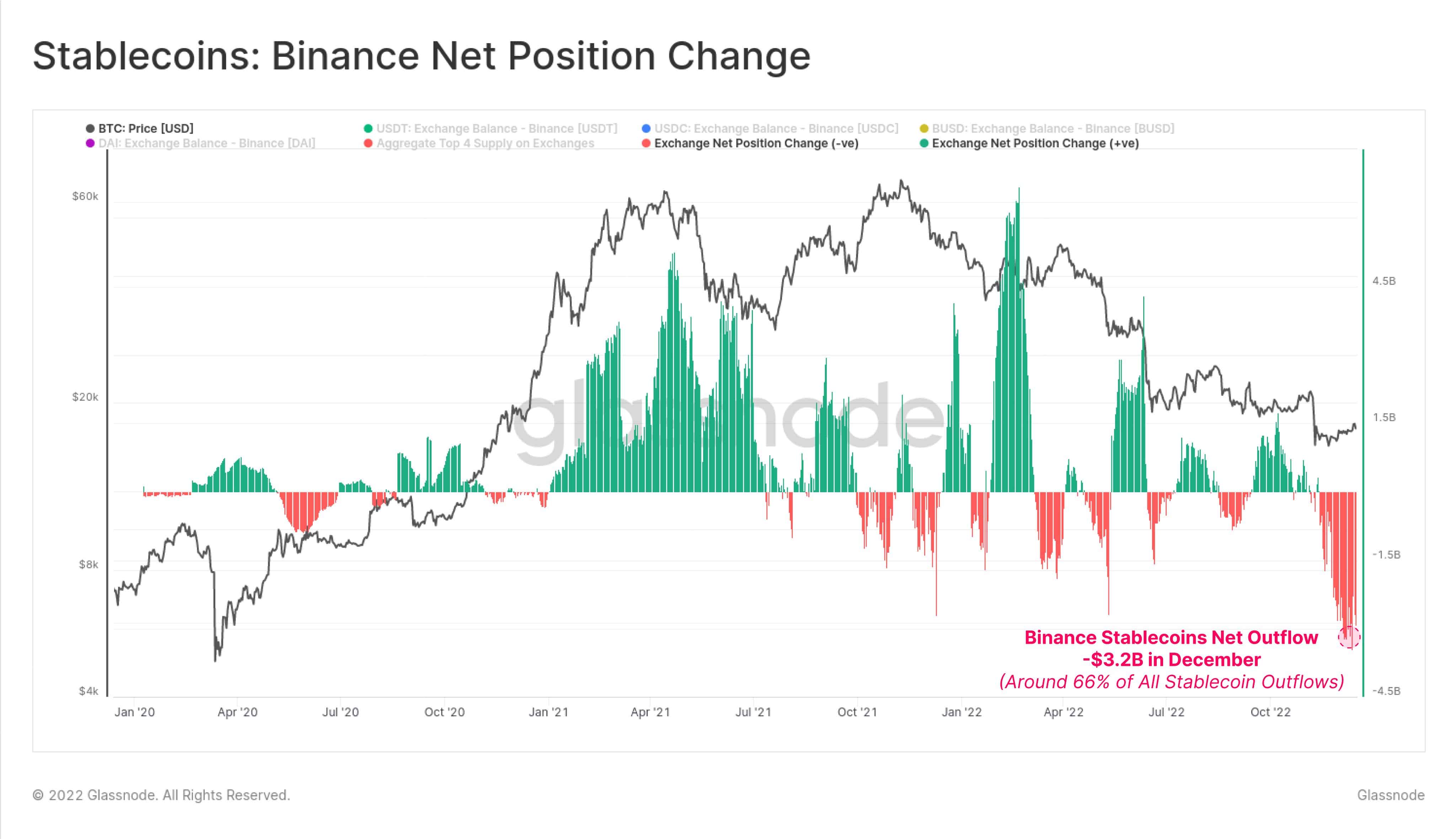

For stablecoins, the most controversial part of the Binance FUD, around $3.2 billion in combined outflows of USDT, USDC, BUSD, and DAI were recorded over the last 30 days. Glassnode noted that the total outflow across all exchanges was $4.8 billion. It means Binance accounts for 66% of stablecoin outflows, in line with market share.

With exchange balances and proof-of-reserves as a nuanced topic, the challenge is PoR requires reviewing both on-chain assets and also off-chain liabilities.

Binance currently holds almost 40 billion in Bitcoin, Ethereum, and ERC-20 assets. So, why Binance has under-reported its Bitcoin reserves?

Also Read: “We’re Financially Strong,” Says Binance CEO CZ

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://coingape.com/binance-news-glassnode-data-reveals-under-reporting-of-por-assets/